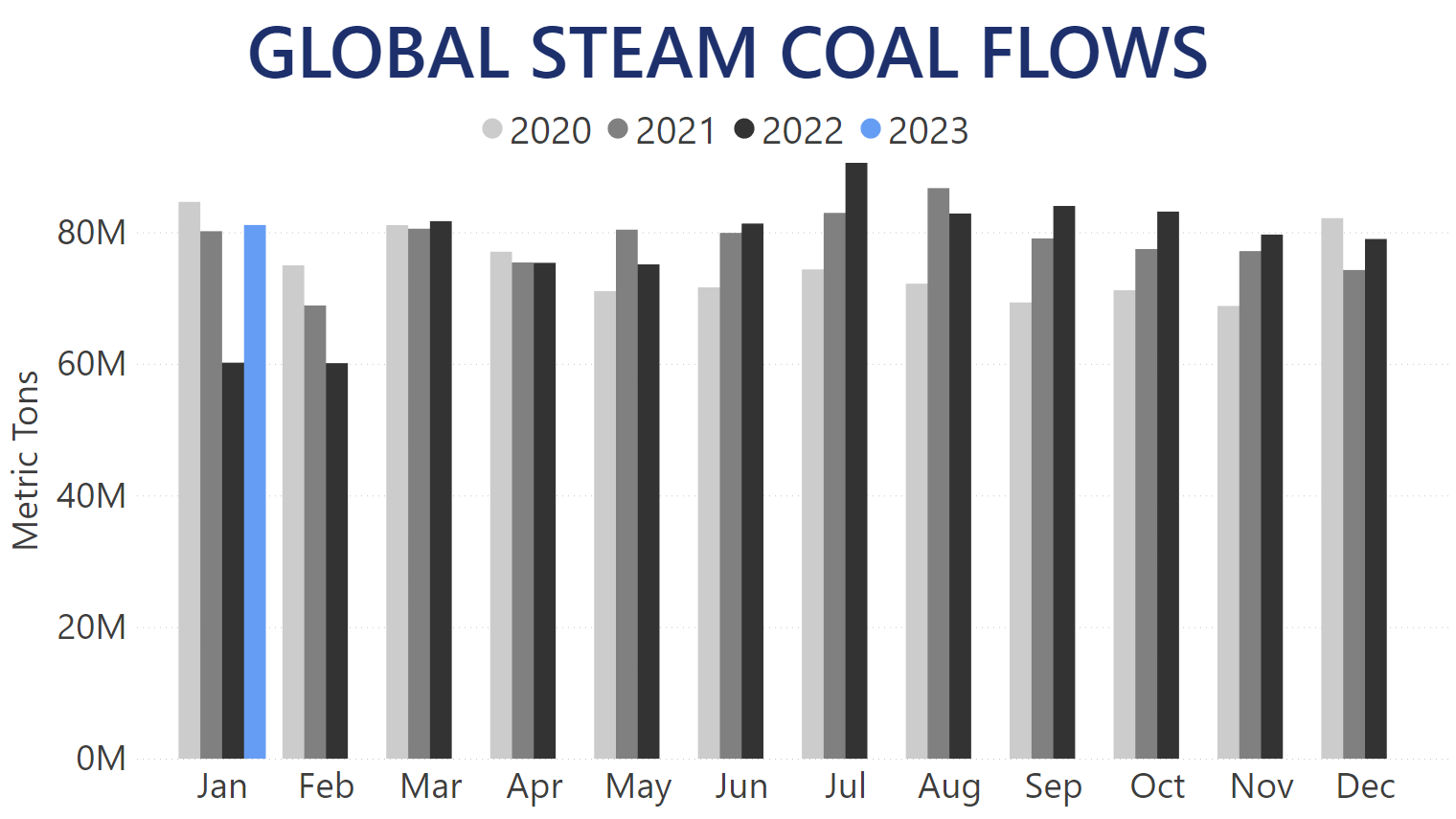

Global seaborne Steam Coal flows continue their upward trend, which we covered at its start last summer, into the new year. Our latest AIS-derived Trade Flows data indicates that every month since last June, bar August, has registered a year-over-year increase ranging between 3.3% and 9.2%. At its peak, Steam Coal flows in July set an absolute record of over 90.5m MT unloaded worldwide.

The upward trend continued into January, when over 81m MT of cargo was discharged across the globe, representing a notable 34.8% year-over-year boost. It also meant that the first month of 2023 was the third-strongest January on record, trailing just after 2020 and 2019 Steam Coal import levels.

Meanwhile, with a week left of February, month-to-date data indicates another strong year-over-year performance, which currently stands at a 23.7% increase compared to 2022 quantities discharged during the same time period.

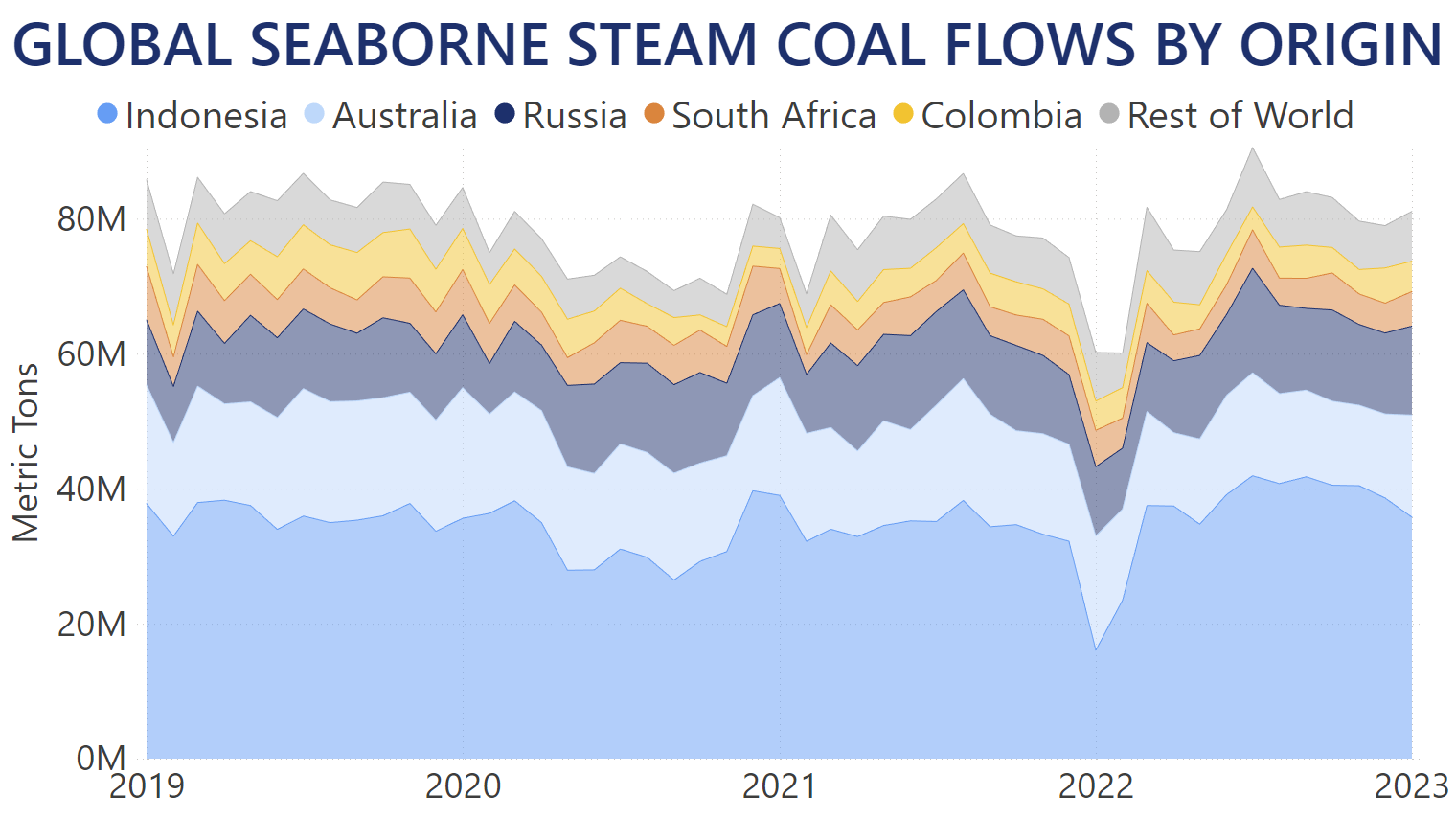

Most of the global seaborne Steam Coal imported in January originated from Indonesia. With over 35.7m MT of cargo supplied, the largest supplier on the market provided over 44% of all the commodity. It also translated into a 122.8% year-over-year increase. However, this number was caused by last year's temporary ban of coal exports in January due to concerns of low supplies at domestic power plants. From a more recent perspective, Indonesian Steam Coal supply has been gradually diminishing since it reached an absolute peak at over 41.9m MT discharged globally last July.

Australia's Steam Coal shipments increased by 21.5% month-on-month in January. However, standing at 15.1m MT discharged, this meant a 10.6% year-over-year drop. Steam Coal from Russia totaled over 13.1m MT last month, increasing by 28.4% compared to January 2022 levels. As in the case of Indonesia, the third-largest provider on the market also reached a historic peak last July, when nearly 15.5m MT of Russian Steam Coal was discharged worldwide.

As the largest importer of seaborne Steam Coal, China discharged over 21.8m MT of the commodity at its ports in January. This represented a 102.4% year-over-year increase, but is directly related to last year's restrictions from Indonesia. On a month-to-month basis, China's imports last month dropped by 8.4%, giving it a market share of 26.9%.

India, typically the second-largest importer of Steam Coal, has been gradually decreasing discharges across its ports since recording an absolute peak last June of over 20.5m MT. In January, Indian Steam Coal imports stood at just under 10m MT. At the same time, Japan has temporarily displaced India from the Top 2 spot over the past two months, importing over 10.8m MT of Steam Coal in January alone for a 7.8% year-over-year boost. South Korea has also ramped up shipments of the commodity, surpassing 8m MT last month for a 7.7% increase compared to 2022 levels.

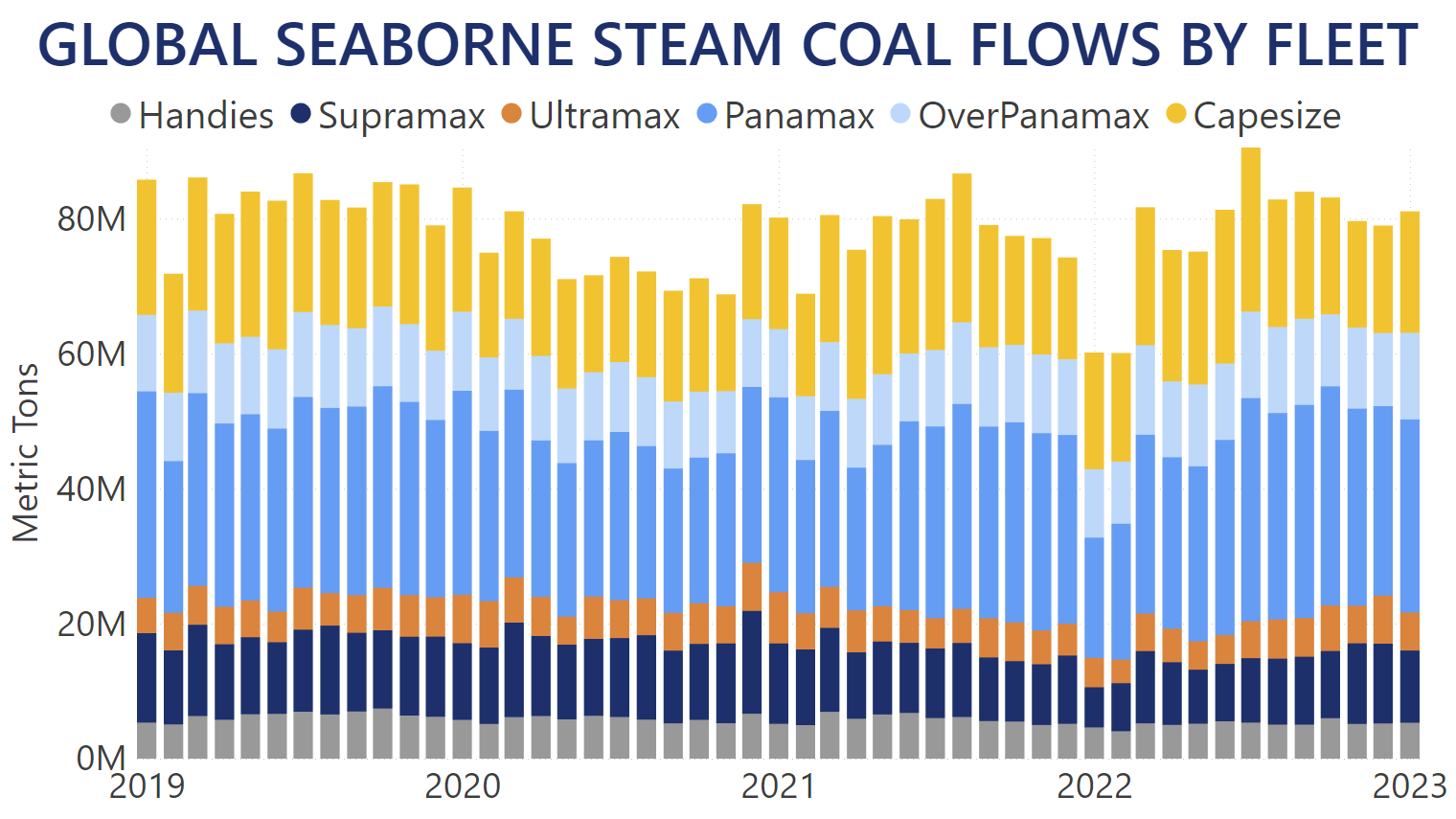

Panamax vessels remain the preferred fleet segment for the transportation of Steam Coal. In January, Dry Bulkers between 68K and 85K MT of deadweight carried over 28.6m MT of cargo, accounting for a 35.3% market share and a 60.4% year-over-year boost. A record for this fleet segment was set last July, when Panamaxes transported over 33m MT of Steam Coal.

Capesize vessels over 100K MT of deadweight were the least affected by last year's restrictions out of Indonesia. Hence, while they remained the second-most utilized fleet segment for the transportation of Steam Coal, carrying just under 18m MT of the commodity in January translated in a "mere" 4% year-over-year boost.

You can follow how the Steam Coal market develops using our Trade Flows tool, as well as gain accurate intelligence on a macro- and micro-level on this and other topics relevant to your business. Book a demo below to see everything Trade Flows can do for you.