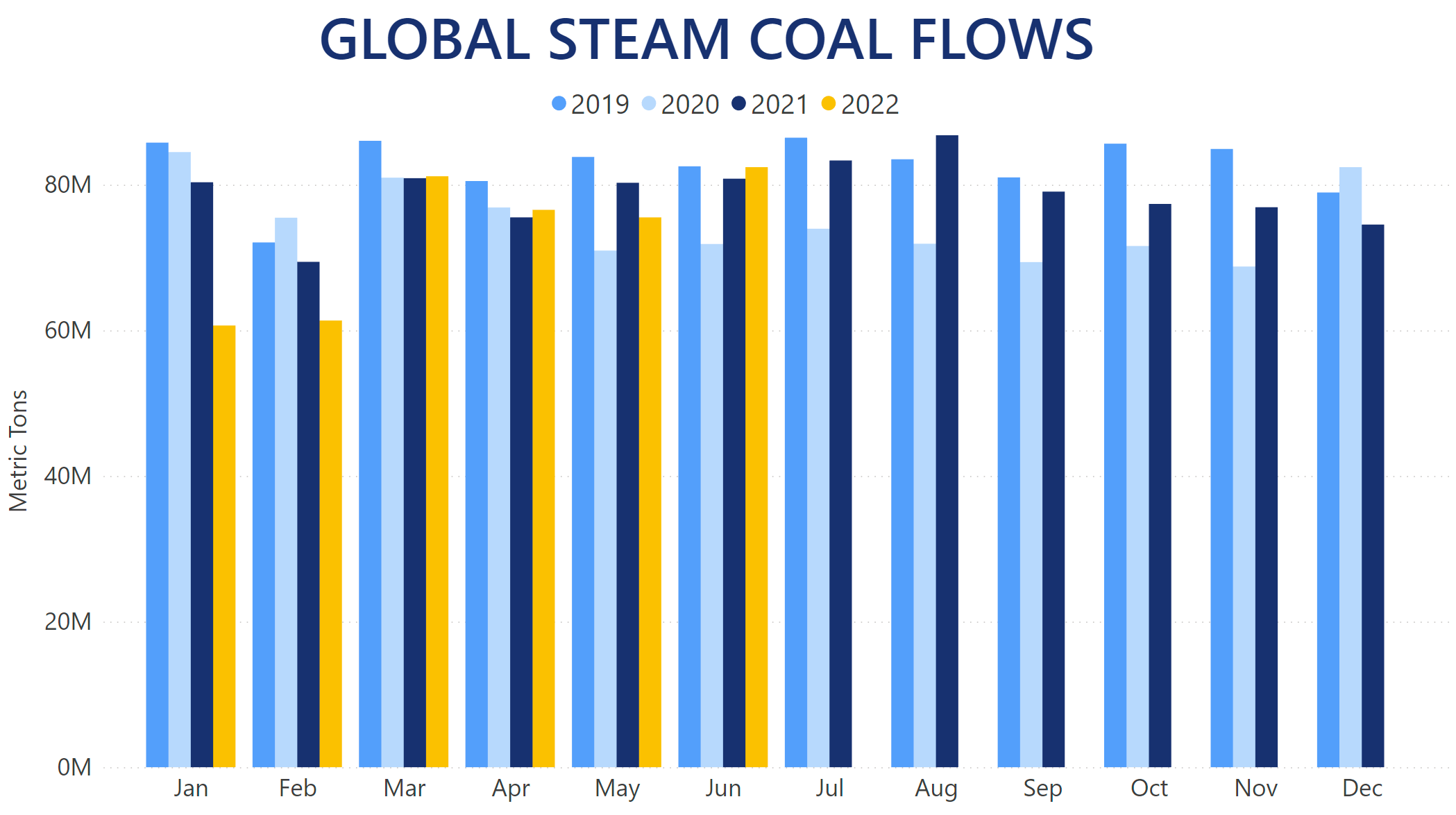

Global seaborne Steam Coal flows, which had stagnated for three consecutive months starting last December, continue their rising trend into June. Our Trade Flows data suggests that March started a reverse trend of incremental increases. Whereas January and February saw record low shipments of Steam Coal at less than 61m MT and 62m MT for a 24.5% and 11.6% year-on-year decreases, respectively, March was the first month in 2022 which outperformed last year's levels. Steam Coal voyages completed in March were also 34% more than in February. April registered a minor month-on-month regression, but with over 76m MT of cargo shipped, it translated into a 1.4% year-on-year boost. While Steam Coal flows in May were retained around April levels, commodity quantities carried in June exceeded 82m MT for the first time in 2022, registering a 2.2% year-on-year increase. This was also only the second time when more than 82m MT were transported by vessel in June, with the previous peak reached in 2019.

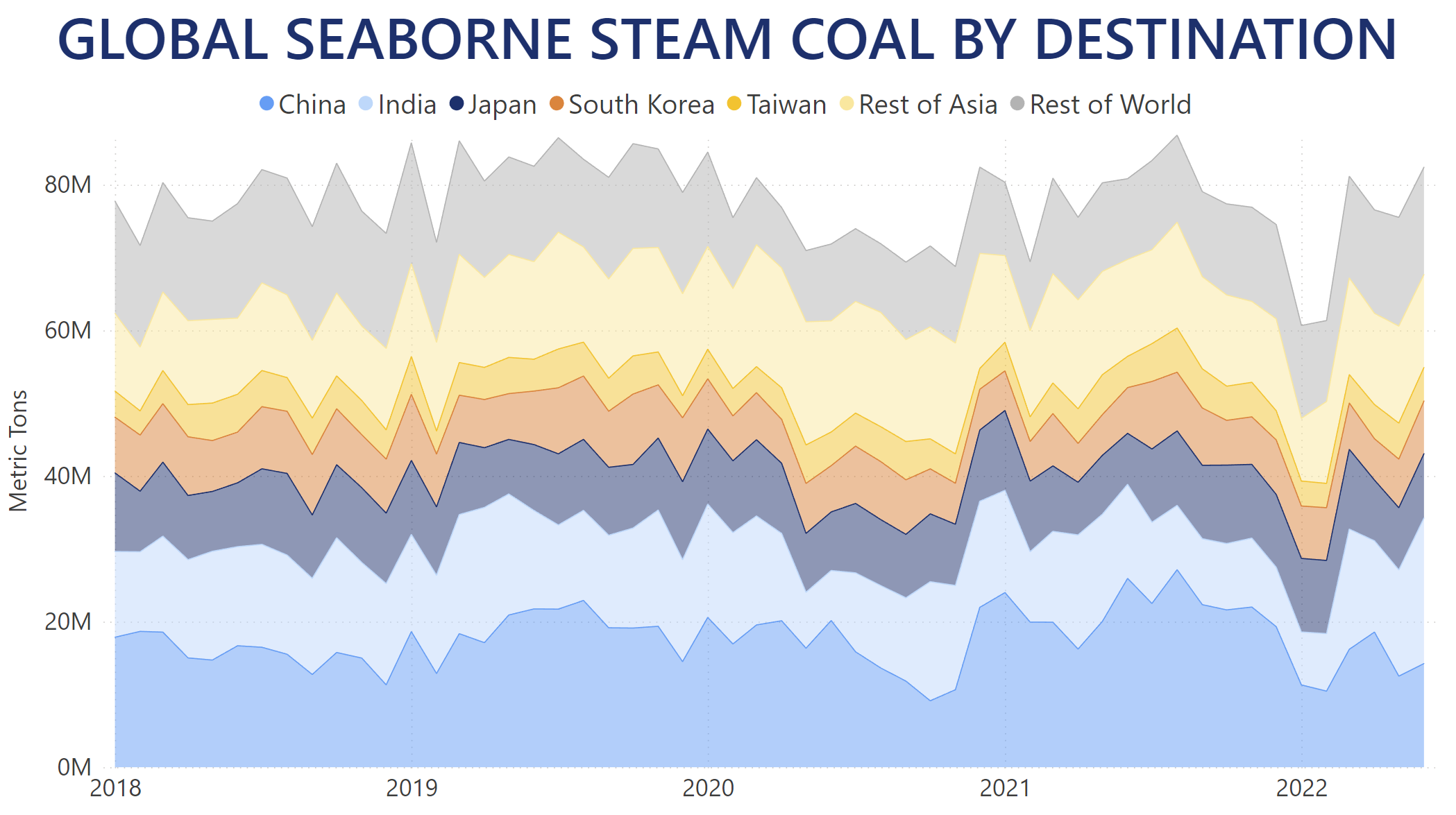

China's seaborne Steam Coal imports have been on the decline overall, with only a single month – April – registering a year-on-year increase. Overall, throughout H1 2022, China imported just over 83.3m MT of Steam Coal, which is a 33.9% year-on-year regression. Unlike other markets, China has never had more than ⅓ market share, but even that has shrunk to 19% so far this year. On the other hand, India's seaborne Steam Coal imports surged in March, May and June, surpassing China for the top spot in market share in these months. Total Steam Coal discharges at India's ports were just under 79m MT during H1 2022, with June setting an absolute record of just under 20m MT, which also translated into a 52.3% year-on-year boost. Japan and South Korea have also increased imports of seaborne Steam Coal so far in 2022. The third- and fourth-largest importers of the commodity discharged over 56.7m MT and 40.3m MT, respectively, for a 9.2% and 14.9% year-on-year gains during H1 2022.

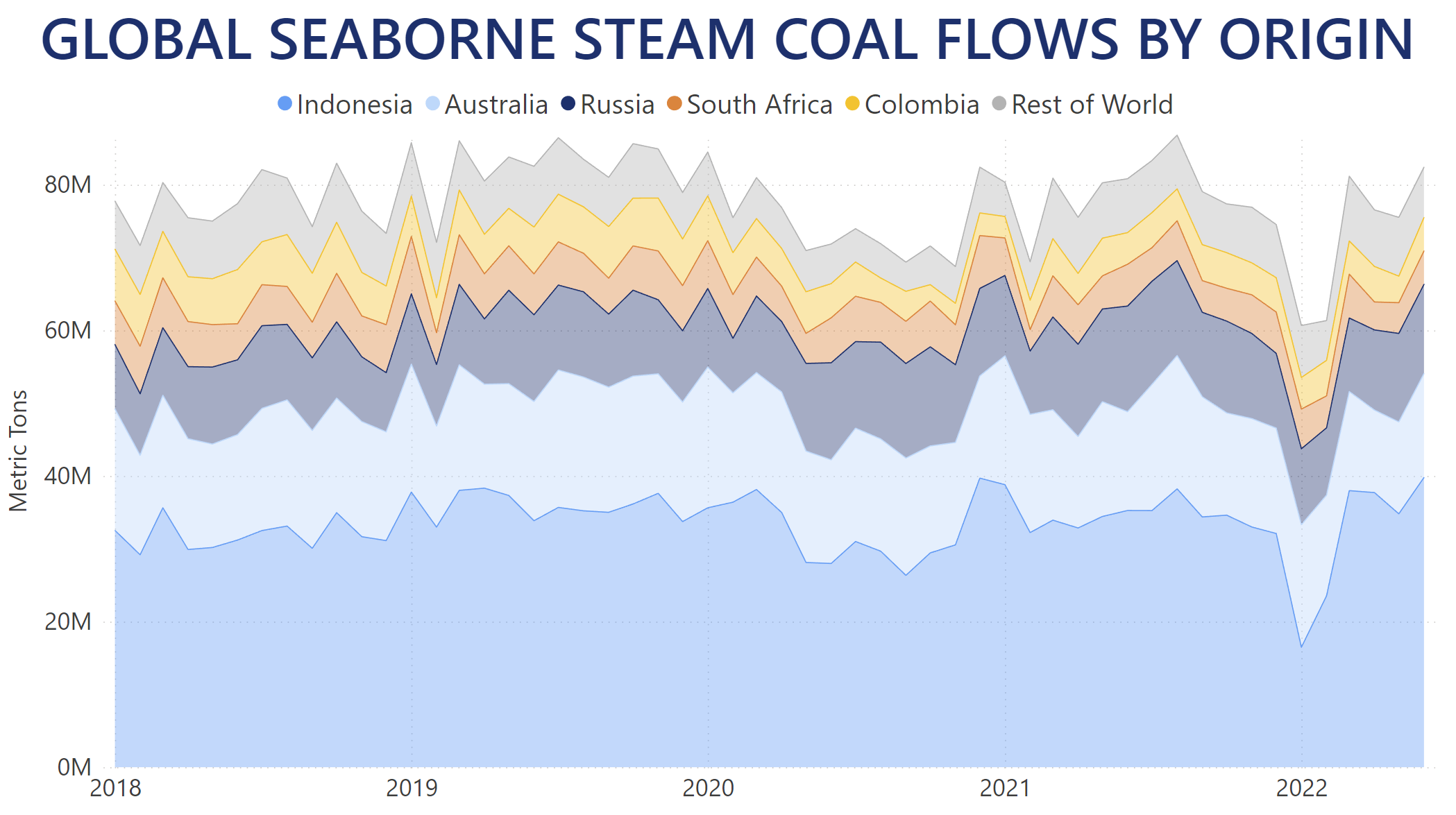

Most of the additional Steam Coal carried by vessel post-February originated from Indonesia, which nearly doubled its monthly exports in March, providing just under 38m MT, or about 47% of all cargo worldwide in that month alone. Indonesia's market share was maintained at this level in the following months, even reaching over 49% in April, while cargo transported in June exceeded 39.6m MT – a peak which was surpassed only once before in December 2020. Meanwhile, Australian Steam Coal were on the decline during the first five months of the year, dropping below 11.4m MT in April – the lowest on record since 2018. Australia's market share thus dropped to under 19% overall throughout H1 2022. Steam Coal flows out of Russia were also reduced since the start of the year by an average of 9.6% compared to 2021 levels. Of the global Top 5 exporters of Steam coal, only Colombia registered a year-on-year increase during the past six months. Over 44.2m MT shipped since the start of the year translated into a 3.9% boost to Colombian exports compared to 2021 quantities.

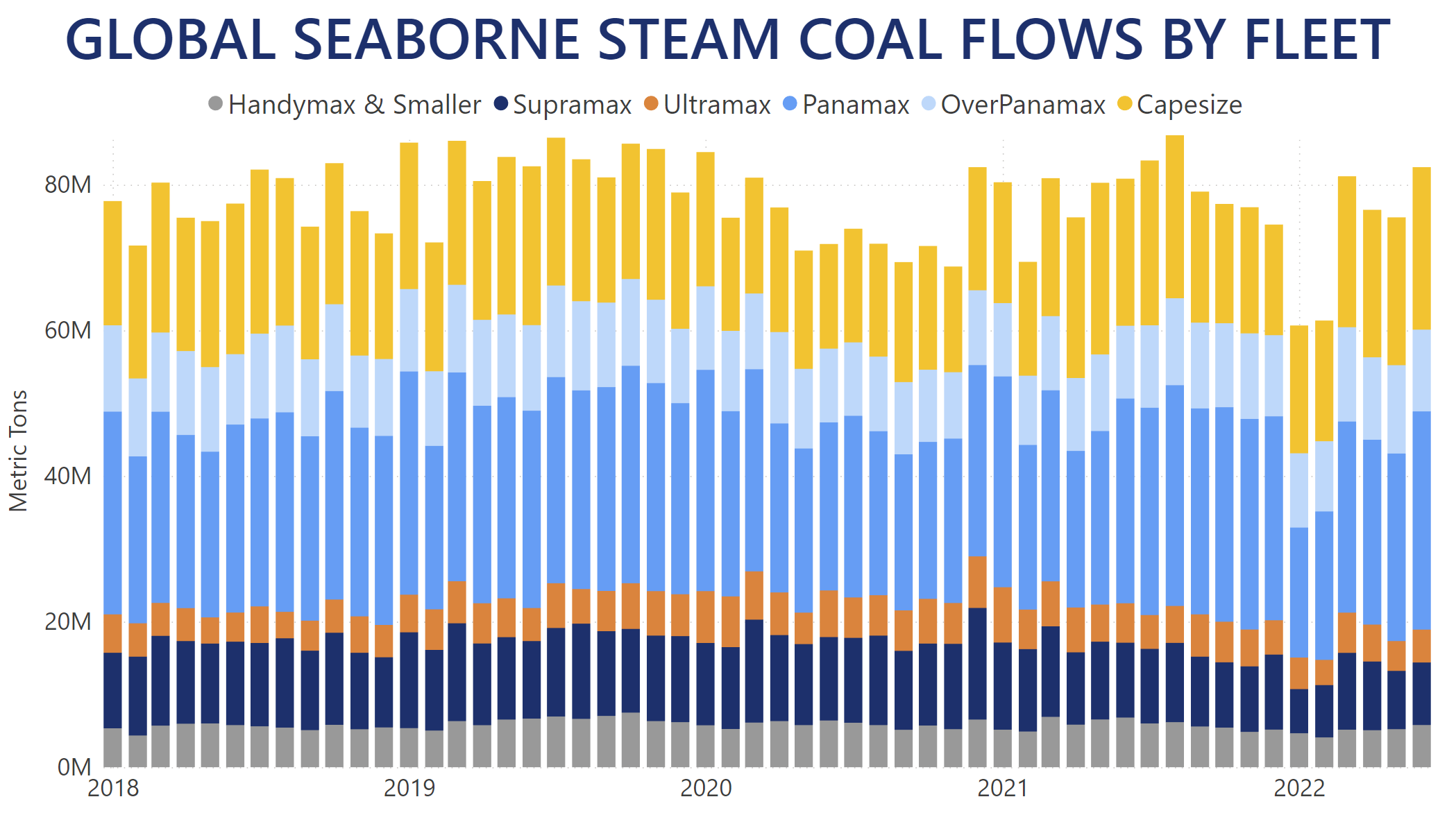

While the first two months of 2022 saw Panamaxes carry 28.4% and 9.9% less Steam Coal year-on-year, the vessels with the largest share on the market carried most of the additional quantities post-March. With about 145.4m MT of cargo carried in total throughout H1 2022, Panamaxes transported 33.2% of all Steam Coal in the market, compared to their share of 32.4% during the same timeframe in 2021. OverPanamax vessels between 85K and 100K deadweight were the only fleet segment, which registered year-on-year increases in every single month since the start of 2022. This gave them a market share of 15.5% in H1 2022, compared to 12.9% they had in 2021. Capesizes were also actively utilized, carrying over 25% of all Steam Coal on the market every single month since the start of the year. In June alone, the largest vessels in this trade transported over 22.5m MT – a milestone surpassed only twice in the last five years, registering an 11.8% year-on-year increase. Overall, Capes carried just under 118m MT of Steam Coal throughout H1 2022 and gained an average market share of 27%, compared to the 25% they had during the same period in 2021.

You can follow how the Steam Coal market develops using our Trade Flows tool. Trade Flows allows you to gain accurate intelligence on a macro- and micro-level on Dry Bulk vessel and commodity movements and trends.