Why estimate CO2 emissions in the maritime industry?

Maritime transport, often seen as a model of efficiency, is also a major contributor to greenhouse gas emissions. With over 1,076 million tons of CO2 emitted annually globally, accounting for 2.9% of the world's annual emissions, its impact is comparable to that of France, Spain, and Italy combined.

Why anticipate CO2 emissions for the years ahead?

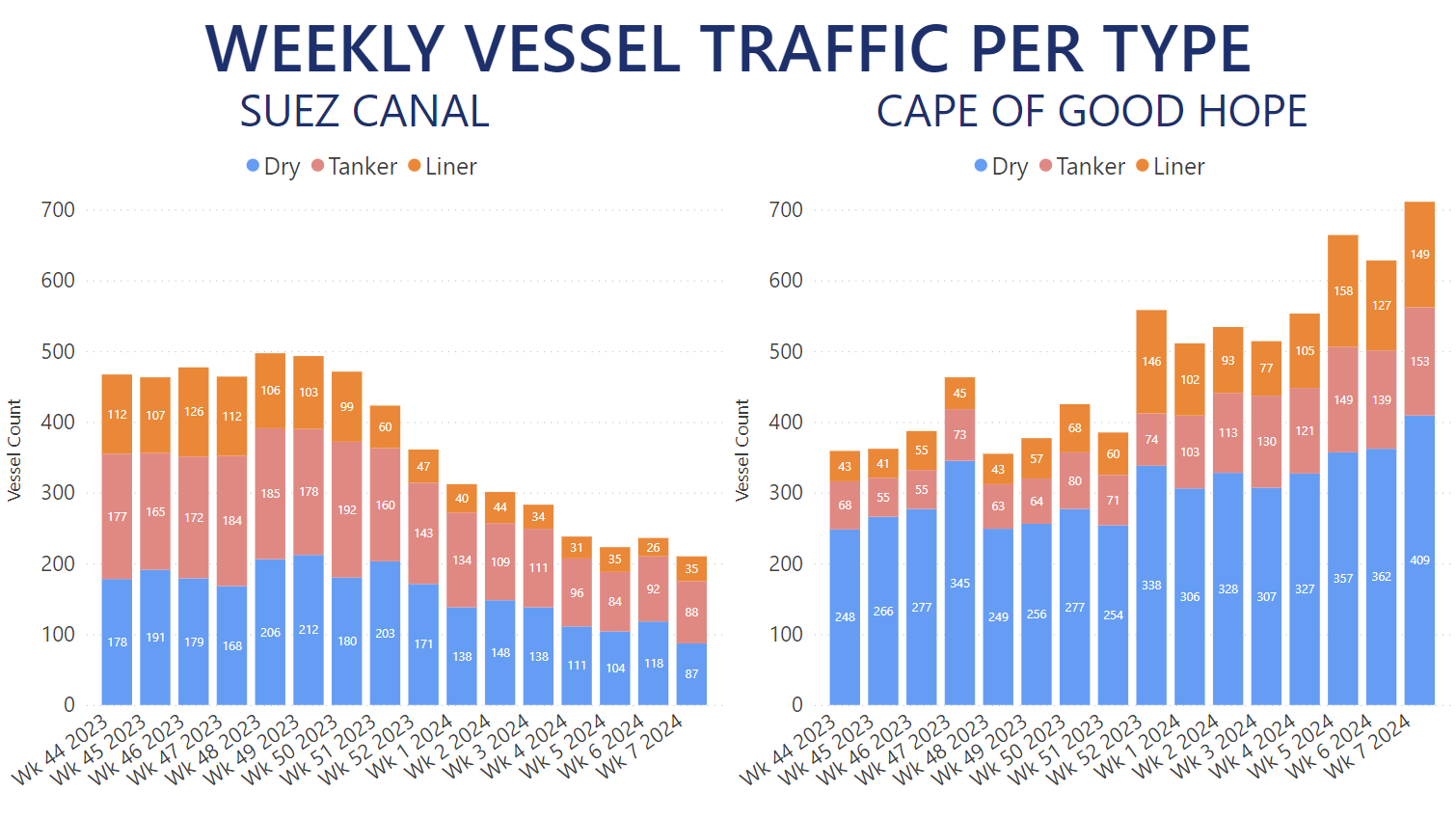

As of January 1st, 2024, significant changes have been made to CO2 emission policies in the European Economic Area (EEA). The European Union (EU) has expanded its scope by integrating maritime transport into its Emissions Trading System (ETS). This measure affects all shipments including grains and oilseeds to and from EEA, requiring ETS CO2 credits to cover cargoes related emissions.

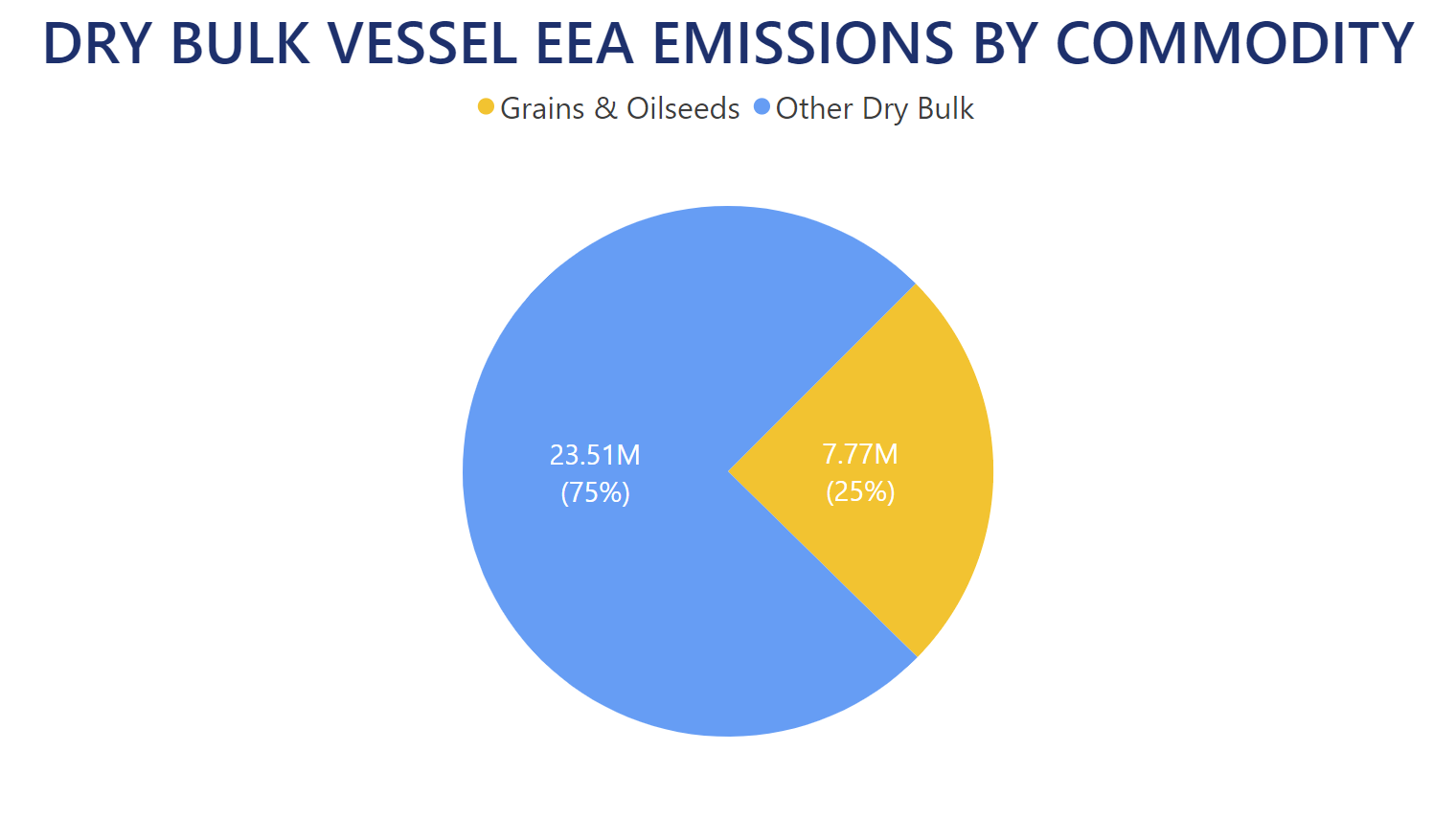

Grains and oilseeds, based on AXSMarine data, account for 25% of all CO2 emissions from Dry Bulk goods trades to and from EEA.

Calculating CO2 emissions for Grains and Oilseeds for EEA

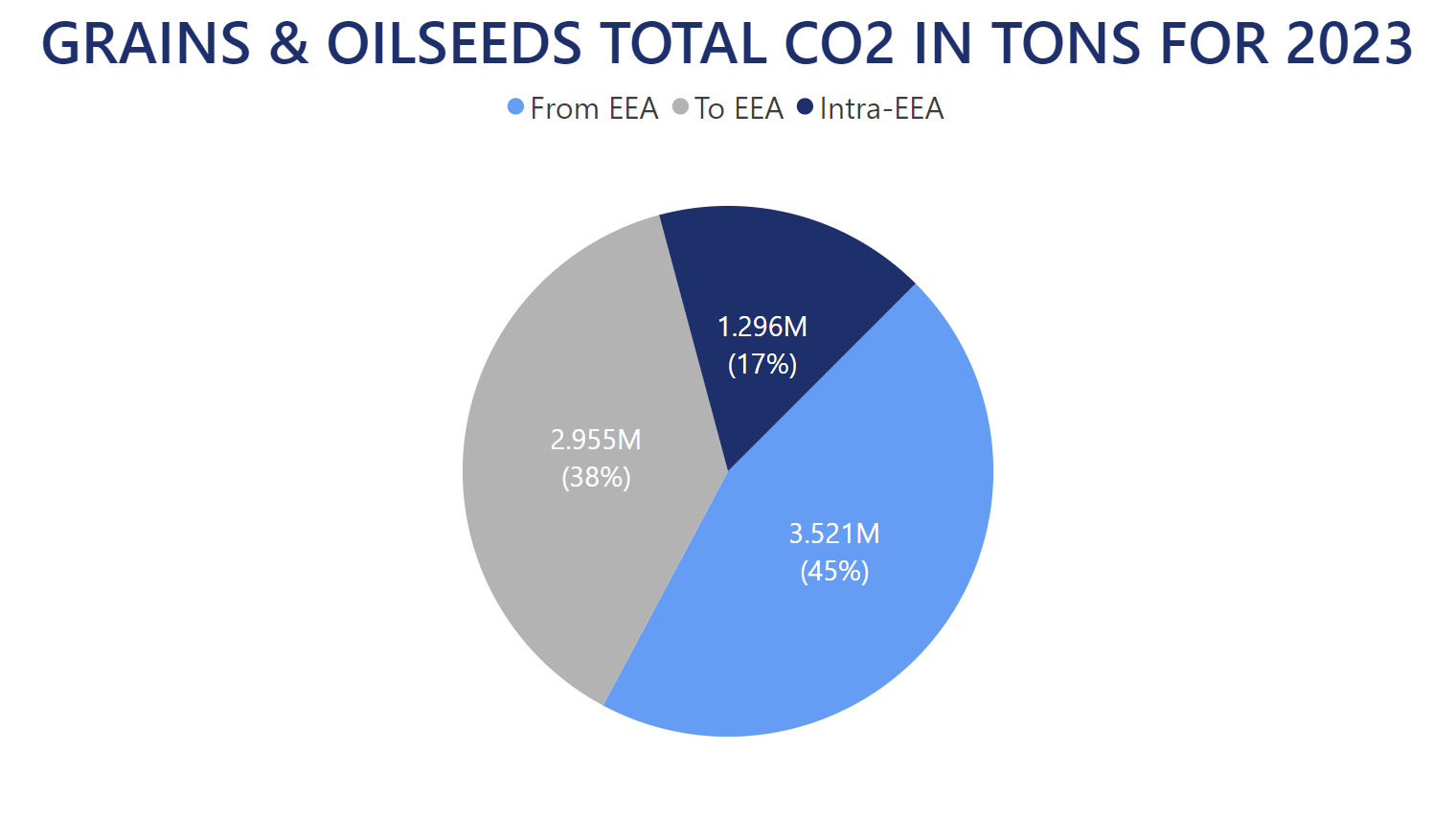

Intra-EEA exchanges are assessed at 100% for ship emissions calculation, while exchanges between the EEA and other countries, meaning imports and exports, are only considered at 50%. This approach aims to allow partner countries the freedom to legislate on the remaining 50% of voyages.

Intra-EEA trade for Grains and Oilseeds accounts for 17% of the total, so only for those 17% of emissions, the EU is considering 100% of the emissions. For Trades from EEA (exports) and to EEA (imports), representing together 83% of the emissions, the EU will consider only half of the emissions on those segments. Notably, the ballast legs for picking the cargo in EEA are also taken in consideration.

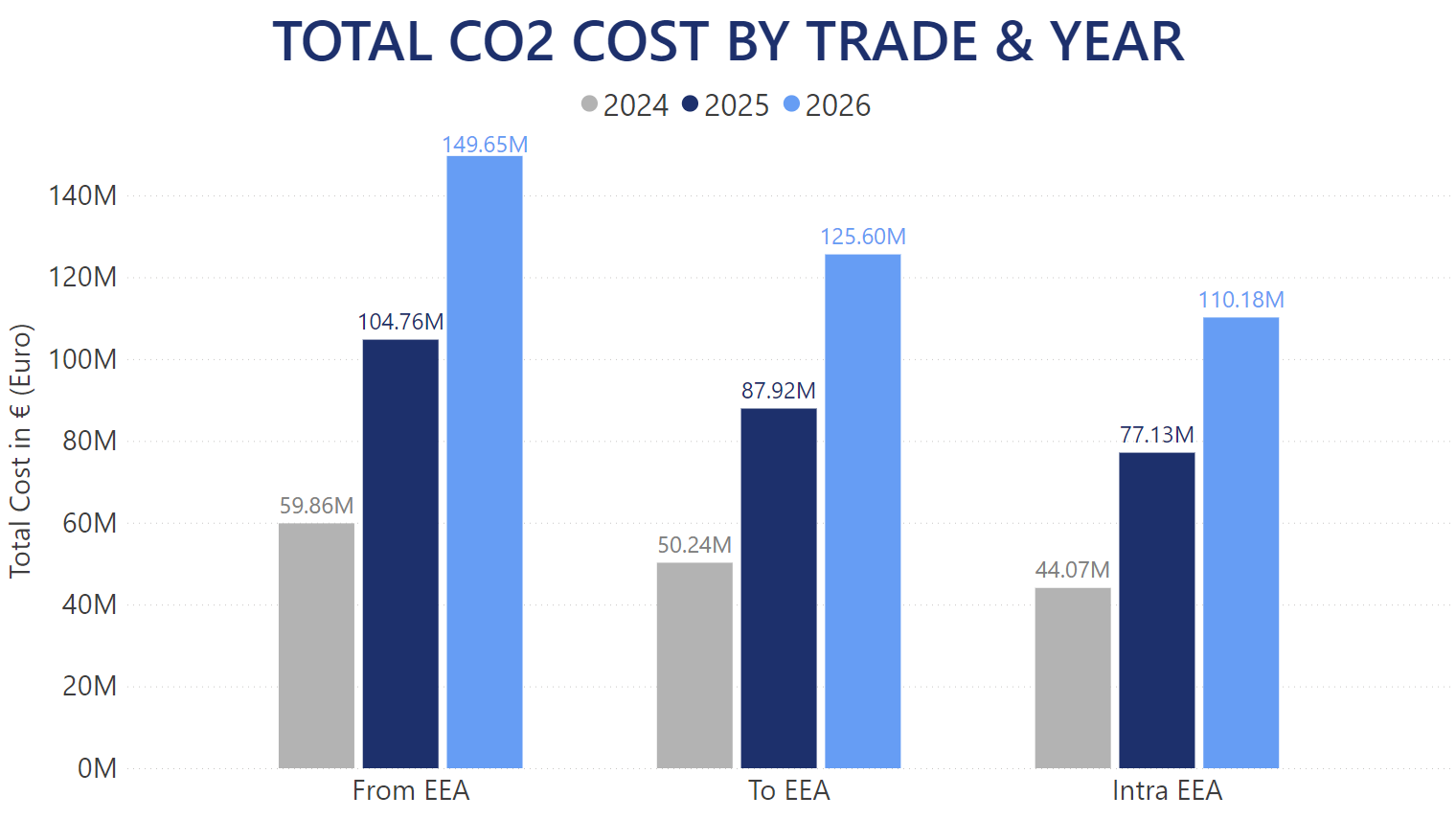

The EU plans a gradual implementation of the scheme, considering 40% of emissions for the first year (2024), 70% for the second year (2025), and 100% for the third year (2026).

From CO2 emissions to impact on trading houses and cooperatives

In 2023, the average price of EU ETS credits was €85 per ton of CO2, while in February 2024, it was €53 per ton. With an expected variation in 2024, shipping companies will need to prove the purchase of ETS to cover 2024 emissions by summer 2025, some companies have already begun sourcing at the current low rate, while others will source later in 2024 or even in the first half of 2025, meaning that the cost estimation remains a forecast at this stage.

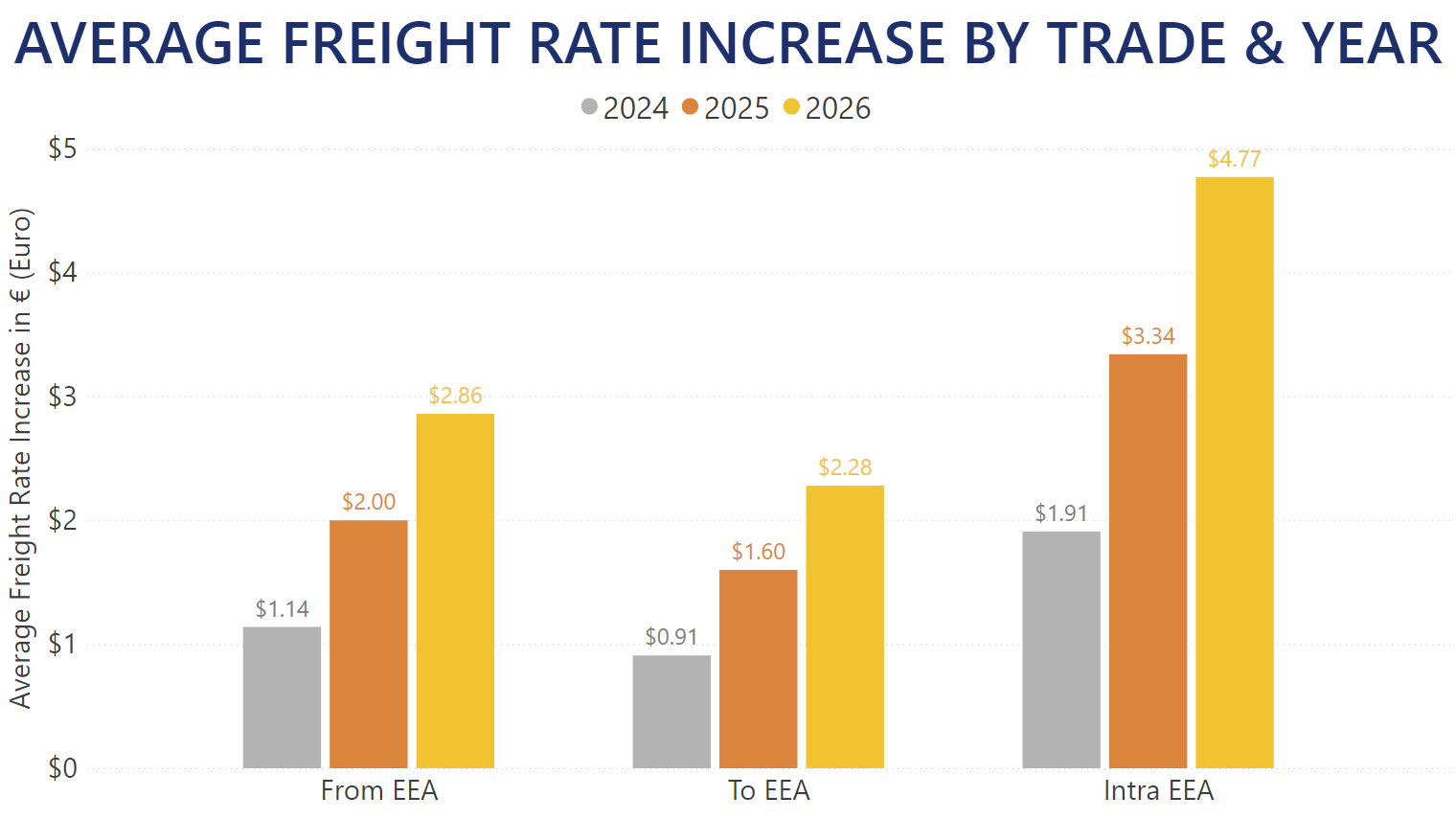

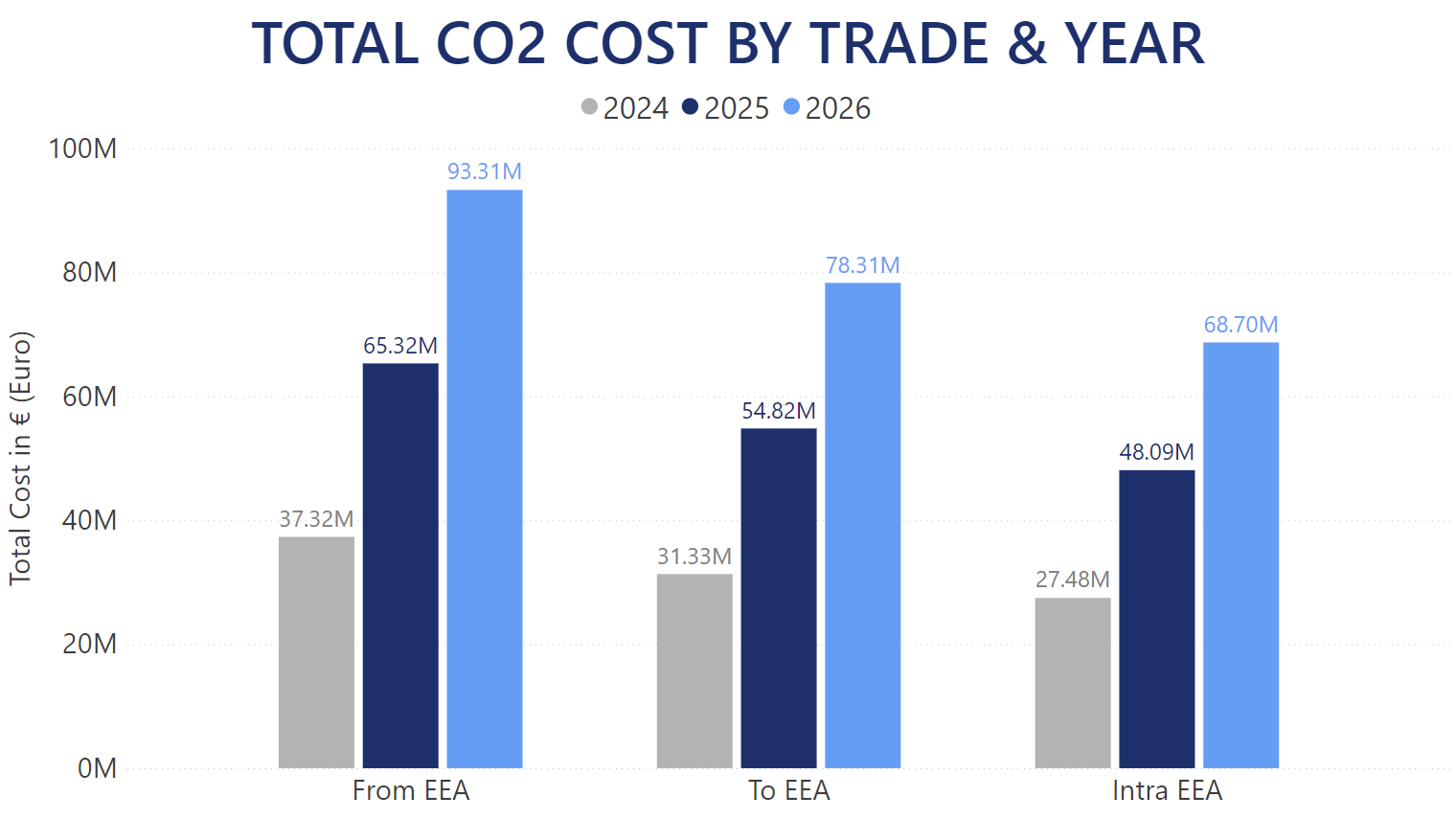

Financial impact on grains and oilseeds, assuming an average ETS credit price of €85 per ton in 2024 (average price of 2023):

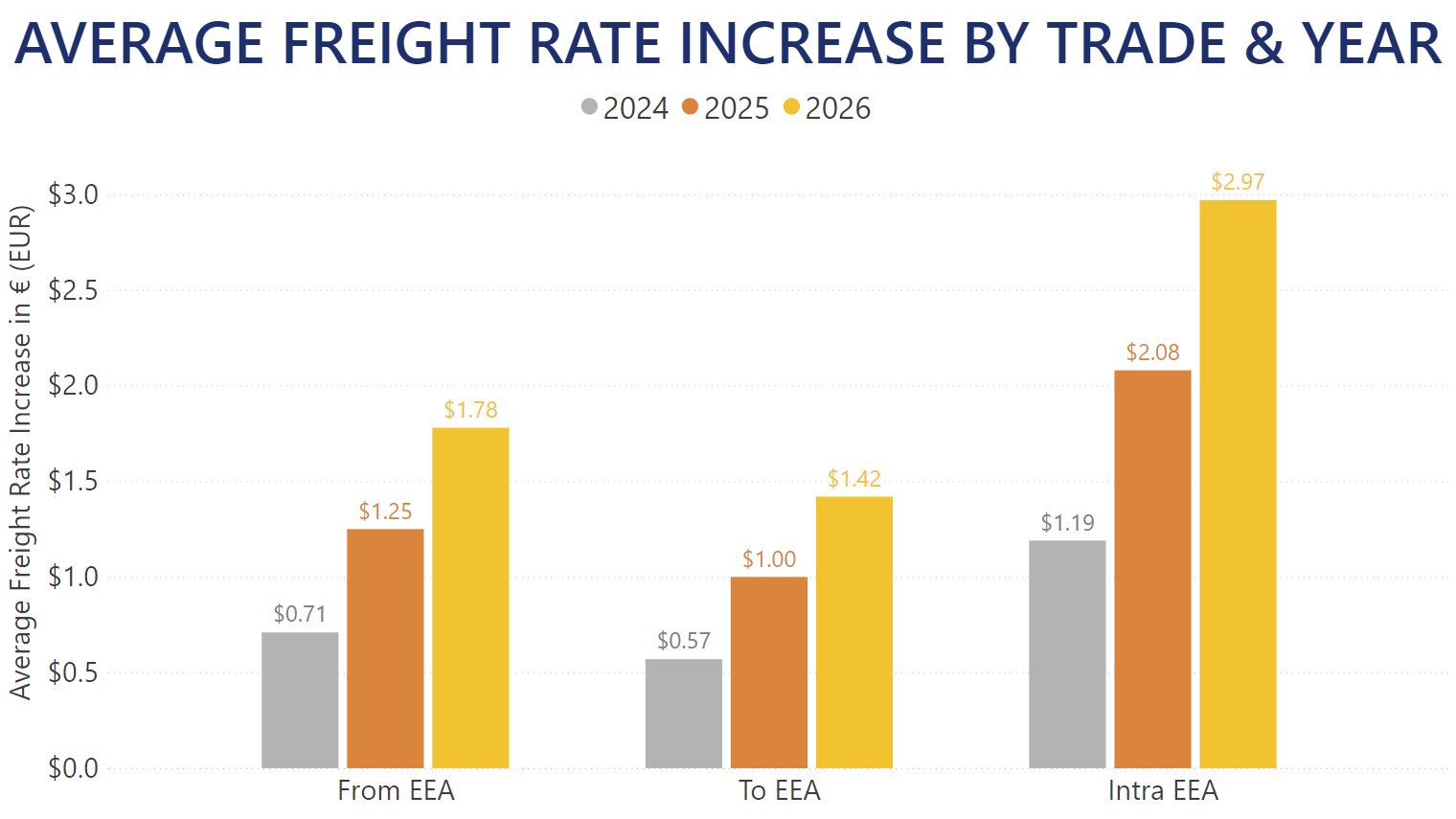

Below with an average ETS credit price of €53 per ton (price in February 2024):

The additional cost of exporting grains and oilseeds from EEA to partners countries in 2024, based on 2023 trades and voyages, would range between €37m and €59m, or an additional freight cost between €0.71 ($0.76) and €1.14 ($1.23) per ton.

For 2026, this would represent between €93m and €149 m in additional costs for exports from EEA, translating to an additional freight cost between €1.78 ($1.92) and €2.86 ($3.10) per ton.

In the wake of these changes, shipowners or organizations responsible for ship operation will need to purchase ETS credits to offset their CO2 emissions. This expense inevitably trickles down to the charterers or trading houses. As Mathieu Mervoyer, a shipbroker from "Barry Rogliano Salles", explains, "While shipowners seek to cover CO2 emissions with credits, the costs are transferred to the charterers in all freight calculations."

On their side the charterers or traders will reallocate the extra costs depending on market trend, Sebastien Heny, a grain trader at "The Andersons" based in Lausanne (Switzerland) notes, "In a bullish market, buyers will absorb additional costs, but in a bearish market, farmers will end up supporting the cost to remain competitive." This observation underscores the intricate dynamics at play, particularly in competitive markets like Romania where farmers may bear the brunt of such costs to compete with non-ETS regulated counterparts like Russian exporters.

Impact on the future of EEA agriculture

On one hand, agricultural production costs may increase if inputs, such as fuels or fertilizers, are subject to emission quotas, potentially reducing farmers' profit margins. On the other hand, transportation costs for agricultural products may also rise as maritime shipping companies must purchase emission credits to offset their CO2 emissions, resulting in higher freight rates.

Nevertheless, these policies also aim to stimulate innovation and the adoption of more sustainable agricultural practices, which could ultimately benefit farmers by reducing reliance on costly inputs and bolstering resilience to environmental challenges. While ETS may initially pose economic hurdles for farmers, it could concurrently pave the way for a more sustainable and resilient agricultural future.

Most revenues generated by the EU ETS contribute to national budgets of the EEA states. Each state will allocate these funds which will be received end of summer 2025 for the year 2024 towards investments aimed at bolstering renewable energy, enhancing energy efficiency, and fostering the development of low-carbon technologies to further mitigate emissions.

You can find further details about our CO2 and CII suite below: