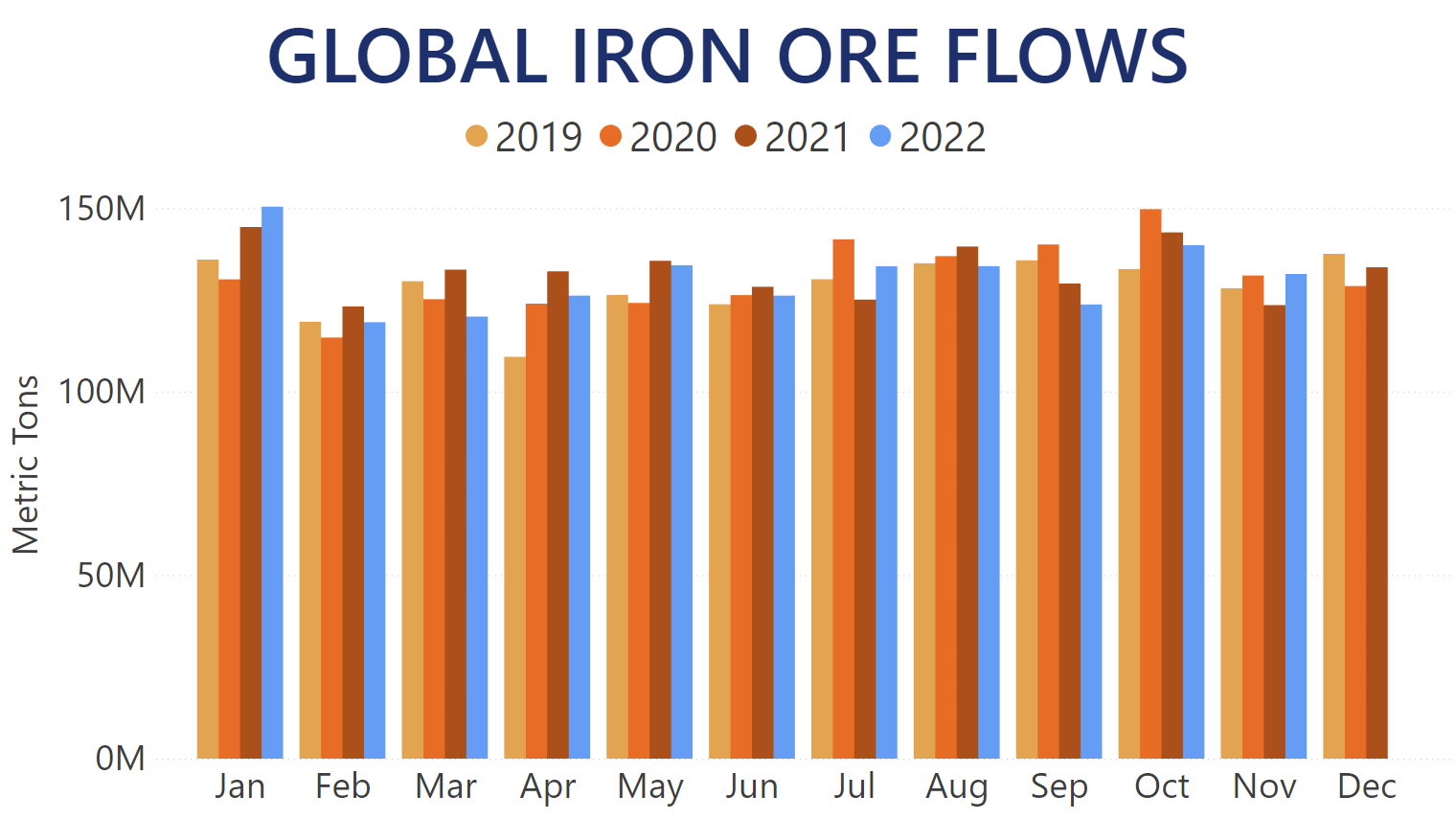

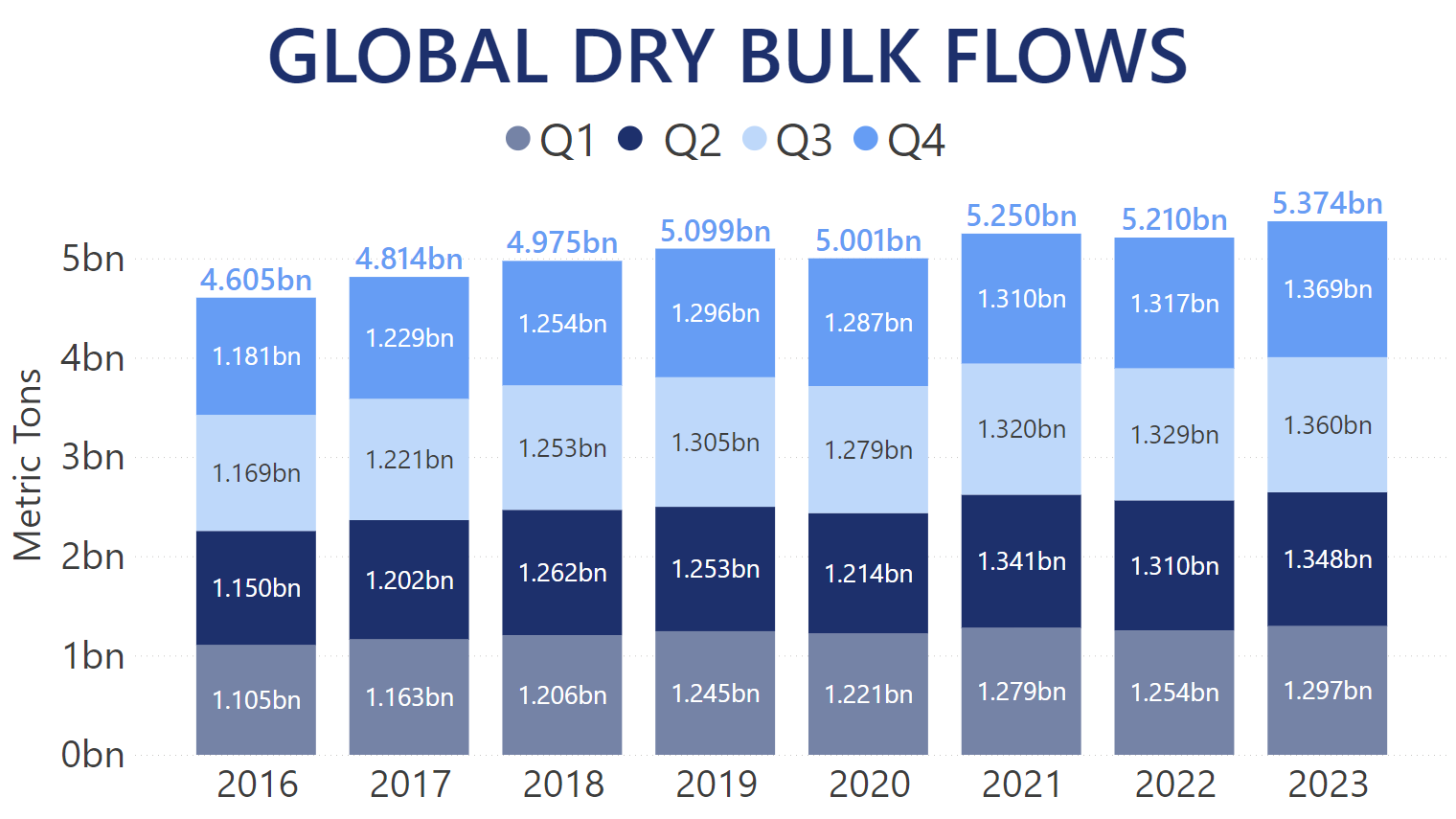

Global Iron Ore flows, which had a relatively strong Q3 in 2022 terms, registered only their third month of year-over-year gains in November. Our latest Trade Flows data indicates that over 132m MT of the most shipped Dry Bulk commodity was discharged around the world last month. This translated into a 6.9% year-over-year boost for Iron Ore flows in November, despite also registering a 5.6% month-over-month decrease. It was also the highest quantity of Iron Ore shipped in a November month over the past five years.

Shipments in October also contributed to a strong start of Q4, with just under 140m MT of Iron Ore carried by vessel worldwide. It was the second-most prolific month so far in 2022 after January and measured a 13.1% month-over-month gain.

Iron Ore quantities transported so far in Q4 of 2022 thus stand at nearly 272m MT, which is a 1.9% increase over the same period of 2021. It is also the second-highest amount of cargo shipped over the first two months of a Q4 on record. Nevertheless, Iron Ore flows in the previous three quarters of the year mean that with a month left until the end of 2022, global shipments are at 1.3% less than they were during the same period of last year.

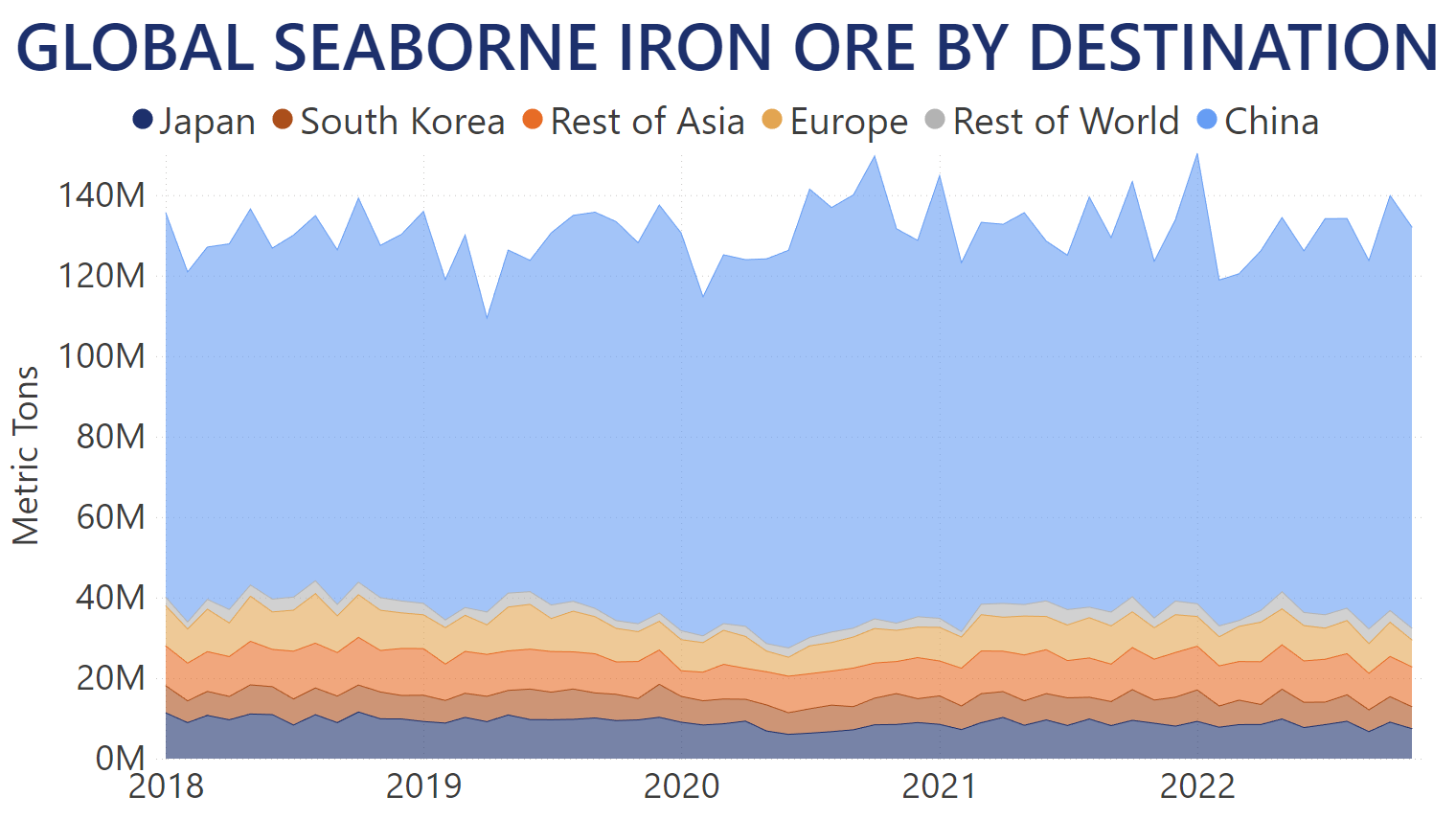

China, the largest Iron Ore importer in the world, unloaded over 103m MT of cargo at its ports in October – on par with last year's levels, and representing a 12.7% month-over-month boost. This was followed up by a strong November seeing shipments total just under 100m MT for a 12.4% year-over-year increase and the highest levels of Chinese Iron Ore imports on record for that month. This also gave China a 73.4% and 75.5% market shares in October and November, respectively, against an average of 72% over the past five years.

Conversely, all the other major importers of Iron Ore discharged less cargo at their ports during the past two months than they had over the same period in 2021. Japan imported 9.9% less Iron Ore year-over-year in October and November. South Korean imports decreased by 11.8% year-over-year, while 8.9% less cargo was unloaded at European ports.

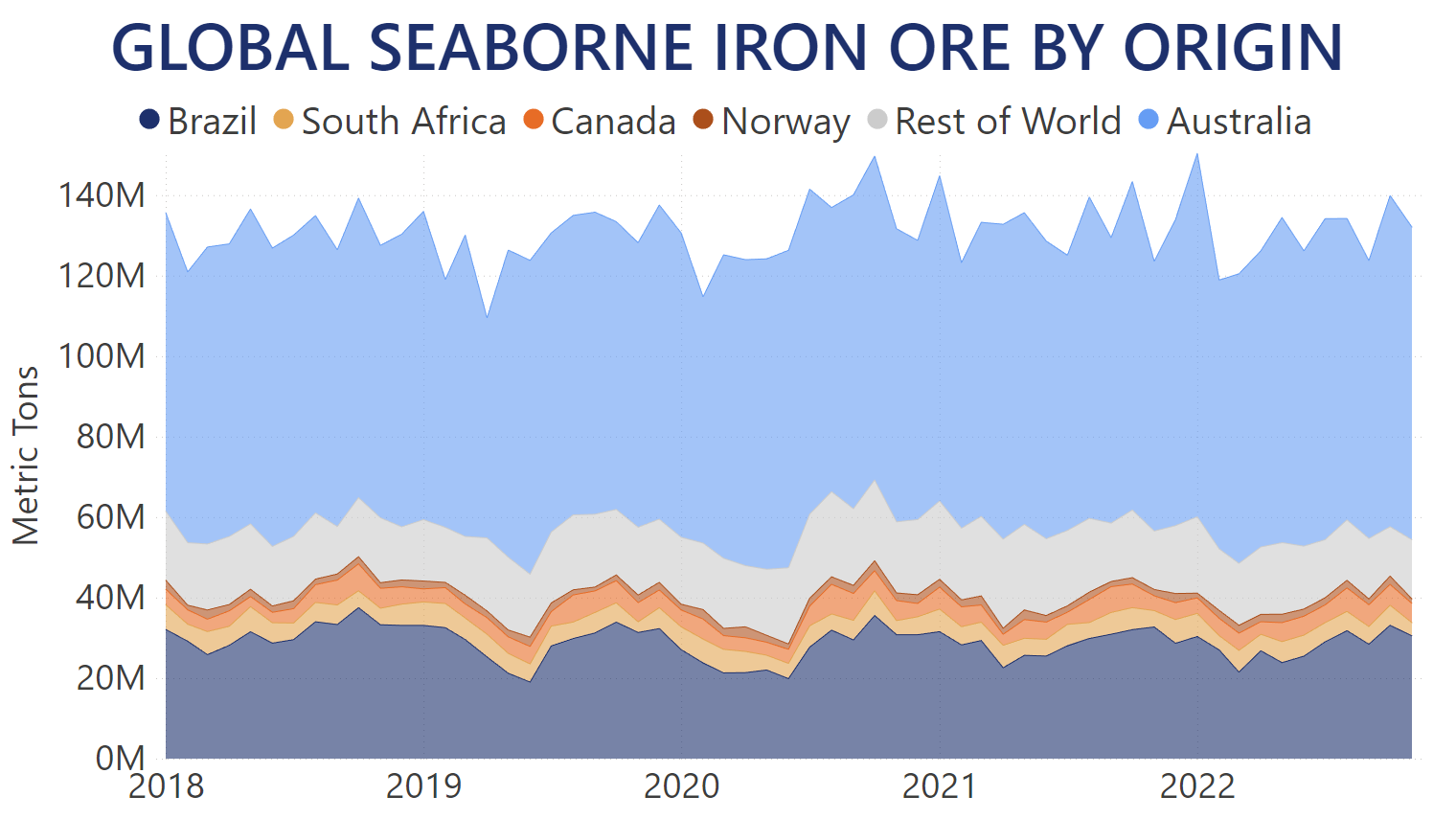

Supply-wise, Australia ramped up its shipments of Iron Ore over the past two months, with over 82.2m MT of cargo discharged around the globe in October. This is the second-highest level on record behind January 2022 and translated into a 19.2% month-over-month increase. Iron Ore flows eased up a bit in November with 77.7m MT unloaded worldwide, which itself was a 15.9% year-over-year boost and the highest shipment level for a November month to date. The past two months gave Australia a 58.8% market share against an average of 56.5% during the past five years.

The second-largest Iron Ore supplier, Brazil, saw a total of 63.6m MT of its commodity discharged globally, which translates into a 1.8% year-over-year drop. South Africa also saw its Iron Ore shipments ease off by 13.2% year-over-year with a total of 8.3m MT supplied in October and November. In terms of total quantity shipped over the past two months, this placed South Africa behind Canada, which provided just under 10m MT of Iron Ore during the same period.

High export duties in India placed the country out of the Top 5 global suppliers of Iron Ore in 2022, with Norway taking its place. The latter has been exporting Iron Ore at levels on par with 2021, with flows in October and November making no exception to the trend.

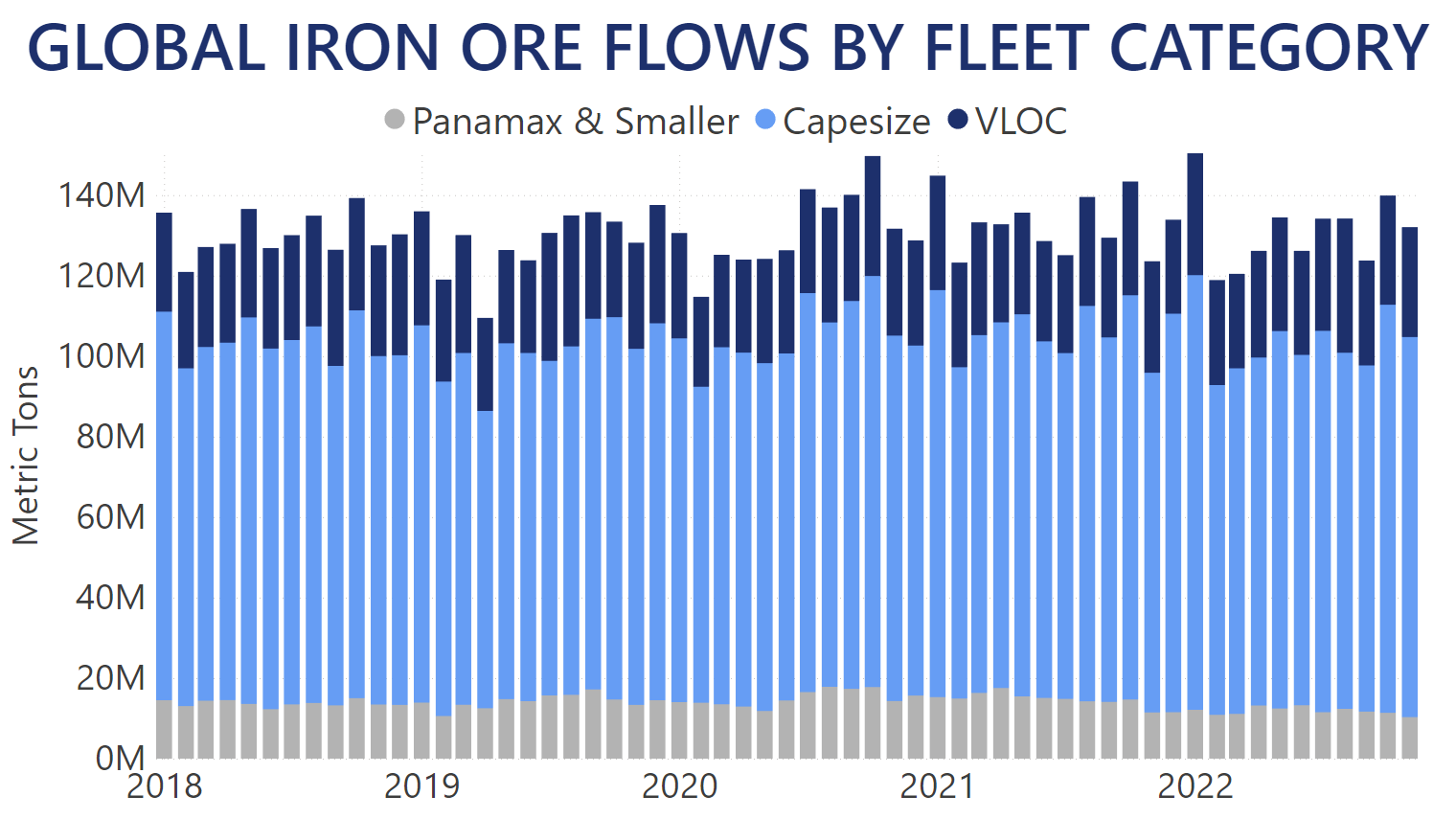

The past two months saw only the Capesize fleet improve its utilization year-over-year in the market. Vessels between 100k and 220k MT of deadweight carried over 195m MT of Iron Ore in October and November, registering a nearly 6% improvement over the same period in 2021. The market share of 72.5% achieved in October, in particular, was the second-highest value to date, while November's 71.5% was also above the five-year-average of 69%.

VLOC vessels over 220k MT of deadweight were used to transport just over 54.4m MT of Iron Ore over the past two months, which represented a 2.7% year-over-year decrease. Vessels under 100k MT of deadweight saw their share slashed even more. With 21.7m MT carried in October and November, Panamaxes and smaller fleet segments registered a 17.1% year-over-year drop.

You can use our Trade Flows tool to follow how the Iron Ore market will end its year, as well as gain accurate intelligence on a macro- and micro-level on this and other topics relevant to your business. Book a demo below to see everything Trade Flows can do for you.