The vast amount of data generated daily, often without our knowledge, is tremendous. From purchasing a pair of pants at a retail store to browsing the internet, our actions generate valuable data. Most people do not realise that hedge funds are using this data to their advantage, refining and analysing it to generate alpha and make informed investment decisions.

In this blog post, we will explore the world of alternative data and how hedge funds leverage it to gain a competitive edge.

Let’s start with a look at what alternative data is.

Understanding Alternative Data and users

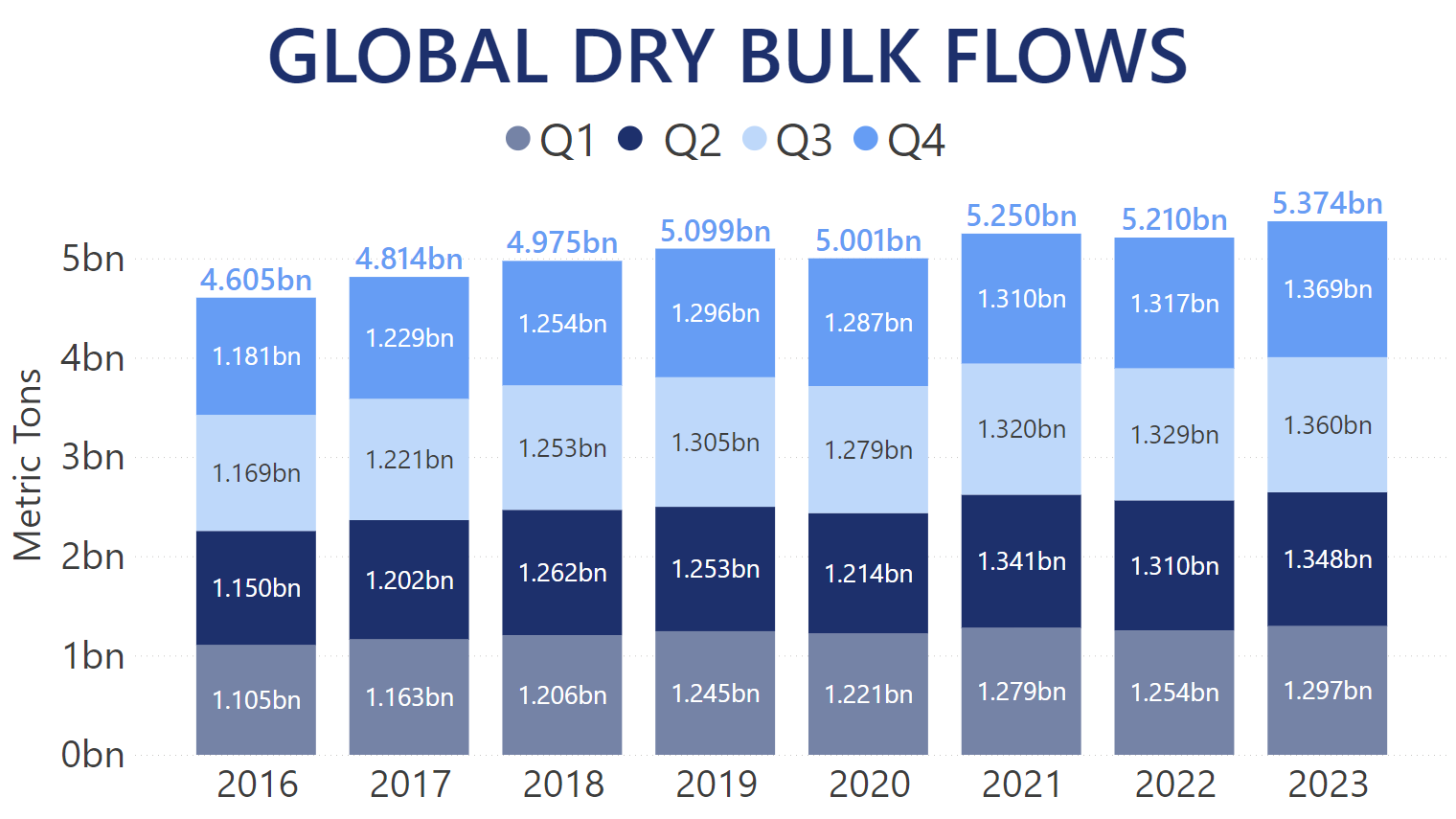

Alternative data focuses on microeconomics and provides insights at a granular level of the world economy. Aggregating alternative data microeconomic signals can generate views and trends for macroeconomic analysis.

For example, monitoring all China industrial commodities imports to anticipate PMI release or monitoring China steel exports live as a proxy of China steel demand (if China exports steel, inland consumption is generally lower than normal).

Alternative data is sourced from non-financial channels such as mobile app analytics, product reviews, and online browsing activity. It offers qualitative or quantitative financial information specific to individuals, businesses, or sectors of the economy.

The Alternative Investment Management Association (AIMA) highlights the different approaches of quants and discretionary managers regarding data usage. Discretionary managers rely on alternative data and fundamentals to validate their trading decisions, combining human judgment with data-driven insights.

On the other hand, Quants also utilise alternative data and traditional data to feed systematic models that make trading decisions without human intervention.

How Hedge Funds Use Alternative Data

It is astounding how seemingly insignificant data points, such as basic retail transactions, can provide valuable insights and information to investors. Alternative data allows hedge funds to extract real-time information from various sources, including mobile devices, social media, satellites, sensors, and IoT-enabled devices.

Fund managers can uncover hidden patterns and trends that traditional data sources might miss by analysing this data. Hedge funds employ various strategies to make the most of alternative data:

- Price monitoring

By monitoring companies' product pricing and inventory levels, hedge funds can gauge market demand, supply, and consumption rates. This information helps them generate alpha and manage risks associated with stocks and bonds.

- News data

Hedge funds rely on alternative data sources to gather news and analyse it to make informed investment decisions. Public data scrapers extract news headlines and other relevant data from the internet, providing valuable insights.

- Market data integration

Hedge funds leverage alternative data to access corporate information and remove redundant data from millions of active websites. This integration helps them understand market trends and make more informed investment choices.

- Enhancing performance

Alternative data provides hedge fund managers with information not easily accessible elsewhere. By sourcing and analysing data from unconventional sources, hedgе funds can outperform their competitors and make more informed investment decisions.

While the benefits of alternative data are clear, building the necessary infrastructure to leverage it comes with challenges.

Challenges and Future Adoption of Alternative Data

While alternative data holds great potential, only 48% of large firms with over $1 billion in Assets Under Management (AUM) currently invest in it. Challenges such as the cost, completeness, relevance, and verification of alternative data need addressing. Difficulties in back-testing historical data and sourcing quality data sets are also contributing barriers.

Alternative data sources may also operate outside data protection regulations. However, with the help of reputable alternative data providers, hedge funds can overcome these challenges and unlock the value hidden in alternative data sources.

Selecting Alternative Data Providers

Hedge fund managers face the decision of whether to develop an internal data ecosystem or collaborate with alternative data providers.

For many, partnering with specialised data providers who excel in sourcing and analysing non-public information proves to be a more cost-effective approach.

Hedge Funds managers must also differentiate good data and data that can generate alpha and returns. Therefore, Alternative data providers who can prove the value of their data by providing use cases and backtests on underlying will have an edge in this growing market.

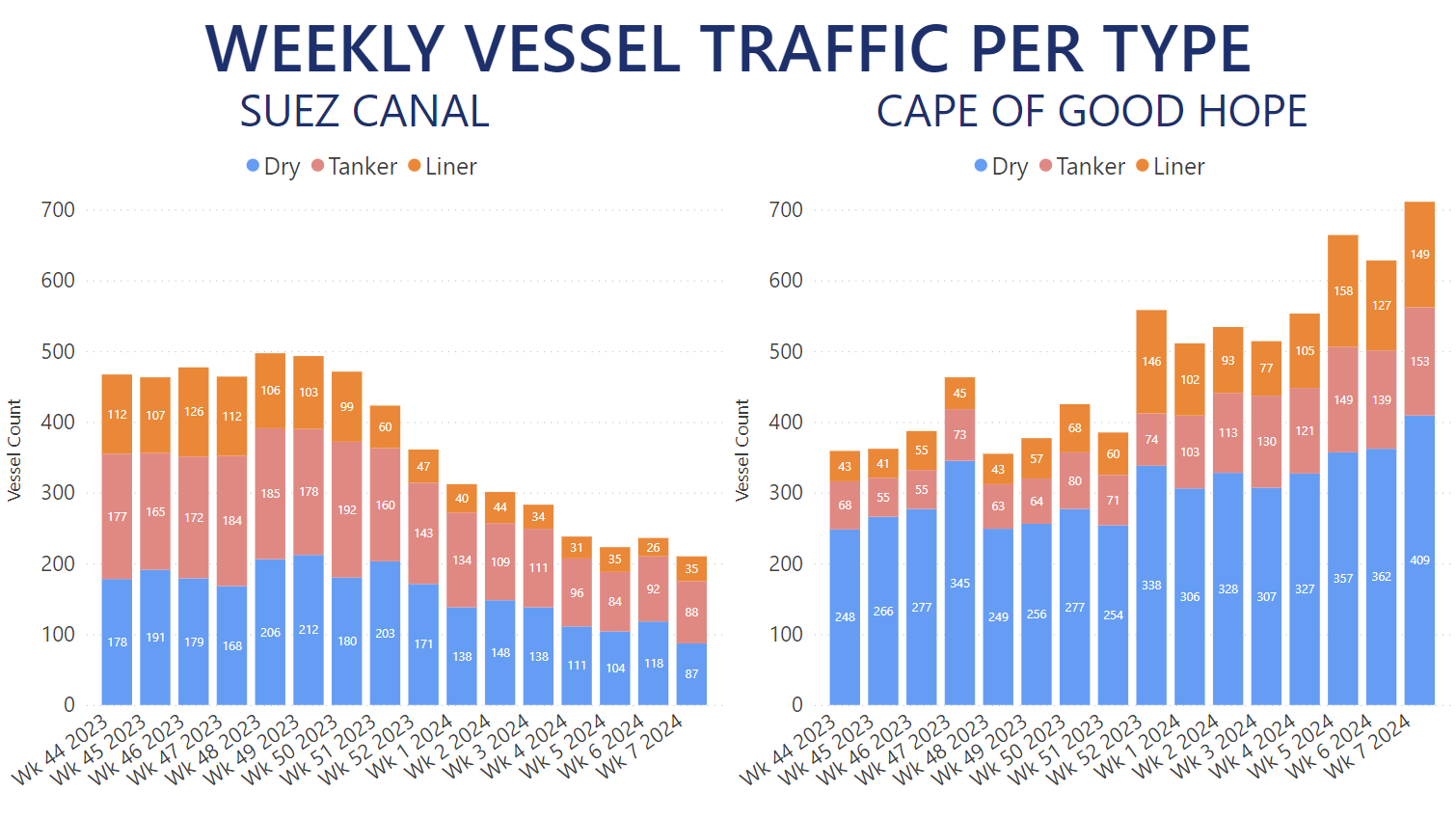

By utilising the depth of information provided by Trade Flows, it becomes possible to analyse commodity movements and trends, uncover unexpected connections between imports and exports companies, consider ESG factors explore commodity demand or supply changes.

This combination of tools empowers hedge fund managers to generate trading signals either for discretionary or systematic trading strategies and make informed investment decisions based on robust data analysis.

Final Thought

Alternative data has emerged as a secret weapon for hedge funds, providing them with a competitive edge in the ever-changing financial landscape.

Adopting alternative data allows hedge fund managers to gain real-time insights, identify investment opportunities, and make informed decisions.

While challenges exist, the future looks promising as market leaders and the rest of the market recognise the potential of alternative data and work towards overcoming the associated barriers.