OPEC+ output cuts, announced in early June, helped VLCC earnings remain close to the US$25k mark in the Atlantic basin last week. The announcement, depressed rates for the MEG and also eliminated the Brent-Dubai premium, which fell from US$ 2.25 per barrel on 5 June to US$ -0.07 on 29 June, and has remained close to zero since that date.

The restricted supply of sour grades following the OPEC+ announcement, along with the August inclusion of WTI Midland in the Brent price as assessed by S&P Global Commodity Insights, boosted exports from Brent-linked oil producing countries by capping the official selling price.

This helped exports of most of the Atlantic basin blends that are priced off the Brent benchmark. Meanwhile, Saudi Arabia threw a spanner in the works in early August by extending its voluntary production cut by 1mbpd through to September.

Almost all refineries in China are designed to process mainly medium sour crude oil, while new refinery capacity coming online East of Suez will also increase demand for sour grades. The output cuts from the Middle East region will reduce the availability of sour grades, pushing the price up for all related blends.

In turn, as the Brent premium comes close to zero or negative, buyers will pay less for a better-quality blend. That market inefficiency is often exploited by traders in the Atlantic basin. However, experience suggests that this ‘anomaly’ will not hold for long. The US decision to engage in a tit-for-tat exchange with OPEC over the possible easing of sanctions from Venezuela would be one way to reverse the premium by adding sour grade into the market.

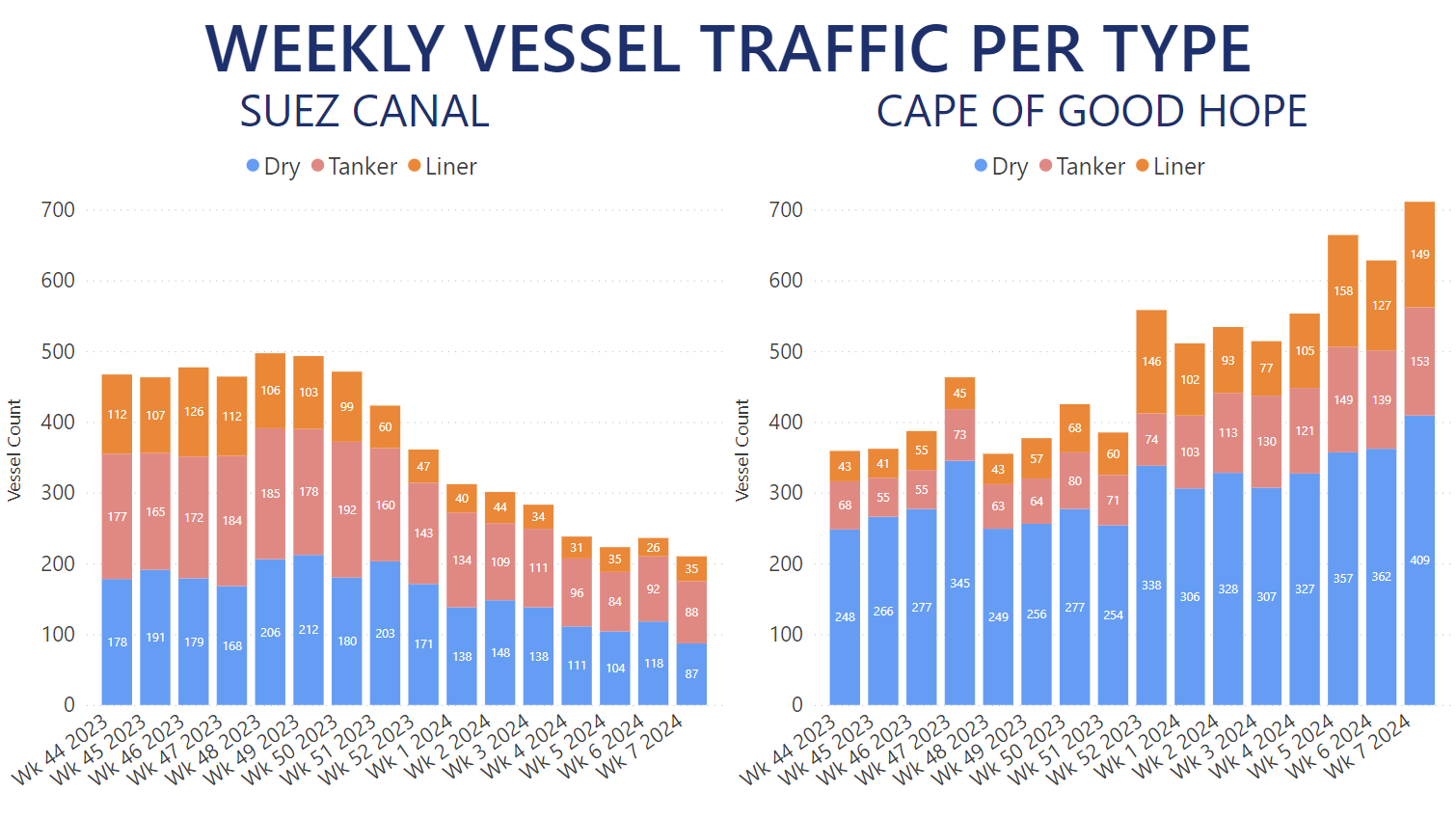

Previous OPEC cuts, despite giving the market a short-term boost, have depressed the VLCC market over the longer term. As shown in Figure 1, after the OPEC cuts, the spread of laden VLCC sailings East and West of Suez starts to

decrease, indicating that several vessels relocated to the Atlantic Basin. This is further shown by the increase in average distances travelled (Figure 3 bottom chart) shortly after the cuts. But despite a short-term increase in distances that

also pushed ton-miles up sharply, as shown in Figure 2, the market remains under pressure, as shown in Figure 3(upper chart), unless both firm MEG stems and longer sailing distances are present.

In conclusion, it is not easy to foresee market tightness going forward unless the main trade lane for VLCCs picks up. Saudi Arabia’s anticipated roll-over of its 1mbpd cut for a third consecutive month into October, as predicted by some market sources, will not help the VLCC market to tighten. Since most of the fleet is engaged in the MEG to Asia trade, evidence of solid fundamental demand will only be clear when the number of laden VLCC on that route increases.

When OPEC has previously announced supply cuts, a Brent discount and strong refinery margins, (as shown in Figure 4) have not been enough to boost VLCC earnings unless Middle East stems also picked up. The recent downturn in the

market is also seasonal, as many refineries in Asia are set to enter their autumn maintenance period.

Nonetheless, the VLCC market is at a very good starting point with floating storage hovering around 8% of the active fleet (as shown in Figure 5). If we add to that low growth in the active fleet, a better market landscape is anticipated in the future.

You can follow the in-depth analysis of OPEC+ cuts and their impact on VLCC using our Trade Flows tool. Trade Flows allows you to discover comprehensive insights on how this affects the market.