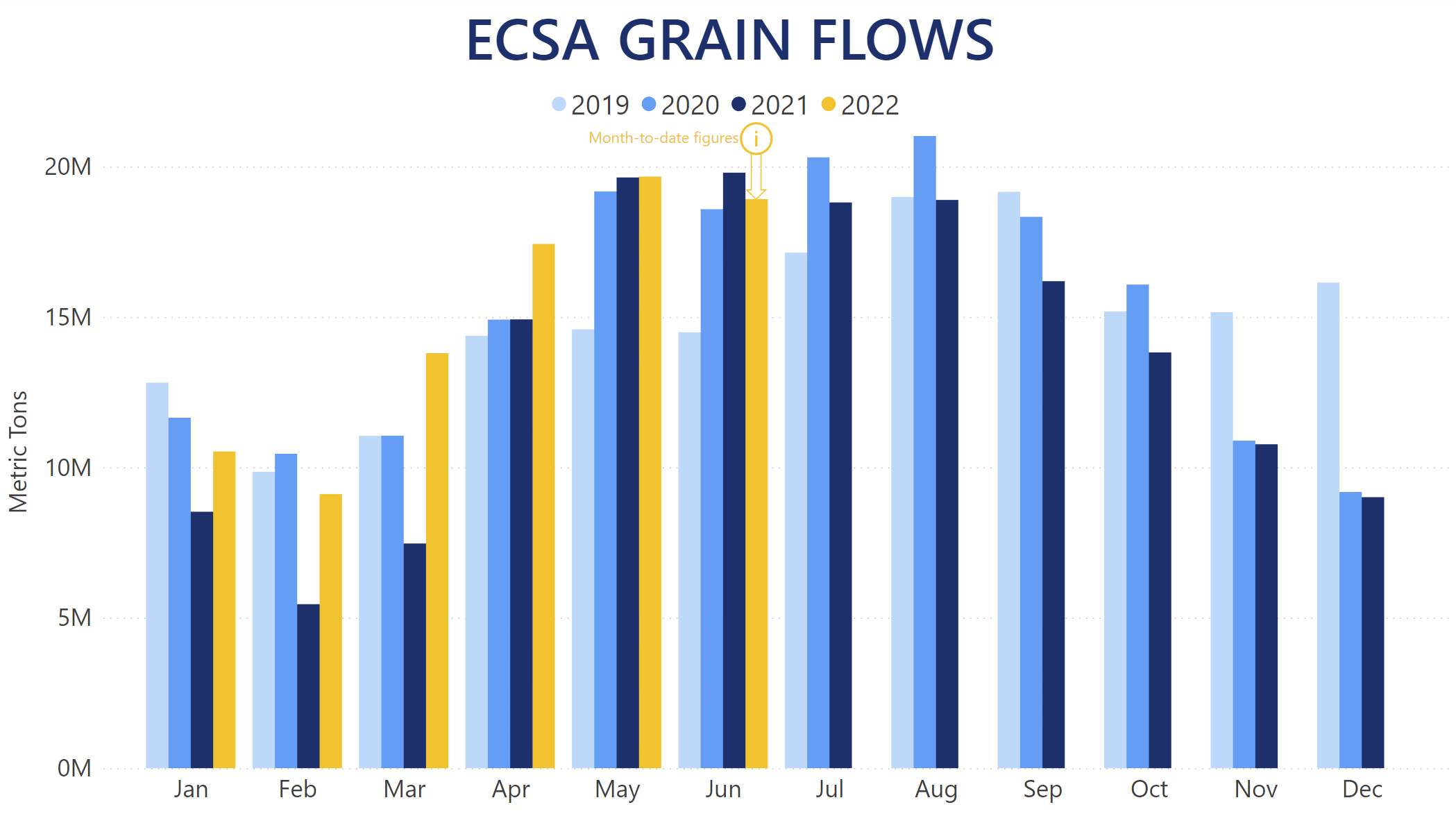

Having started the 2021/2022 season strong, grain flows out of the East Coast of South America (ECSA) region are still on the upward trend. Our Trade Flows data suggests that after setting record export levels of 14m MT and 18m MT in March and April, respectively, quantities discharged globally in May kept up pace with the record-breaking 2021 levels at over 19.6m MT. With two days to go until the end of June, current shipments are also on par month-to-date with last year's, exceeding 19m MT. Overall, H1 2022 Grain shipments from the ECSA region registered an 18.2% year-on-year increase with just under 90m MT discharged worldwide. This makes the past half year the strongest first half on record, topping the previous peak set in H1 2020 by 4.4%.

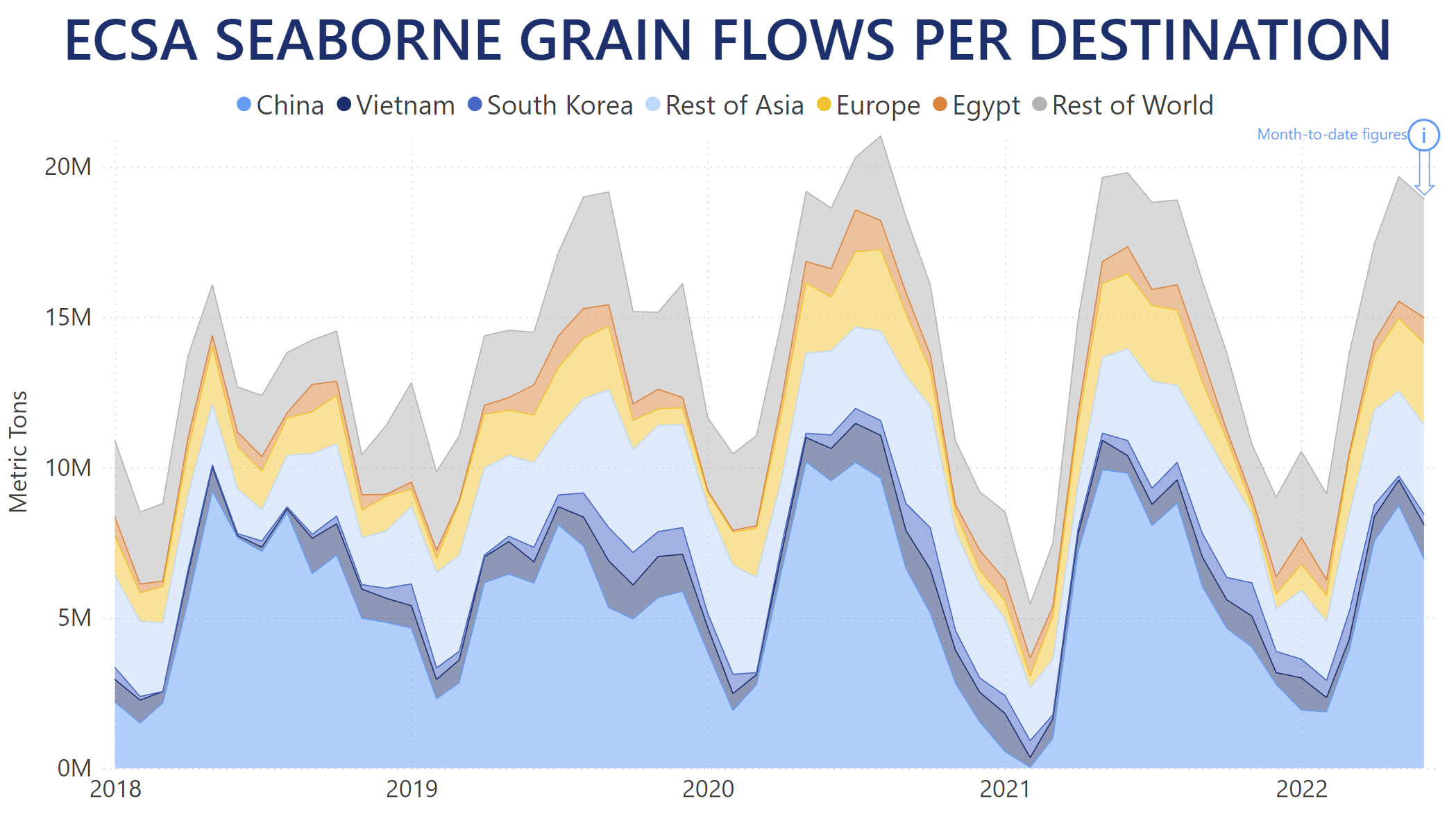

Chinese imports of ECSA Grains commenced 2022 at a strong pace with over 15m MT discharged between January and April, registering a 76.3% year-on-year increase, and gaining a 30.1% market share, whereas it stood at 24.2% during the same period of 2021. However, China eased off shipments over the past two months and while its imports increased by 15.5% month-on-month in May with over 8.7m MT discharged, this was also a 12.3% year-on-year decrease for the largest importer of ECSA Grains. China's market share has further dropped to less than 37% with just over 7m MT discharged so far in June – a rare occurrence during the summer months over the past 5 years. Overall performance of Chinese imports of ECSA Grains in H1 2022 measured a 9.3% year-on-year boost.

The second-largest single-nation importer of ECSA Grains, Vietnam, has consistently boosted discharges of this commodity type each month since the start of 2022. Importing over 4.6m MT of cargo throughout H1 2022 translated into a 7.2% year-on-year increase. South Korea also increased its import levels by 37.7% compared to 2021 quantities, having discharged over 3m MT of ECSA Grains at its ports between January and June. The other Asian nations combined accounted for another boost of 24.1% year-on-year after importing a total of over 16.2m MT throughout the first half of this year.

European nations also ramped up their ECSA Grain imports, discharging about 10.7m MT of cargo throughout H1 2022. This meant an increase in demand of over 12.6% year-on-year and gave Europe a market share of 11.9% during the first six months of the year. Between January and June, nations outside the traditional top importers of ECSA Grains, such as Algeria and Iran, also boosted discharges at their ports by 40.3% year-on-year.

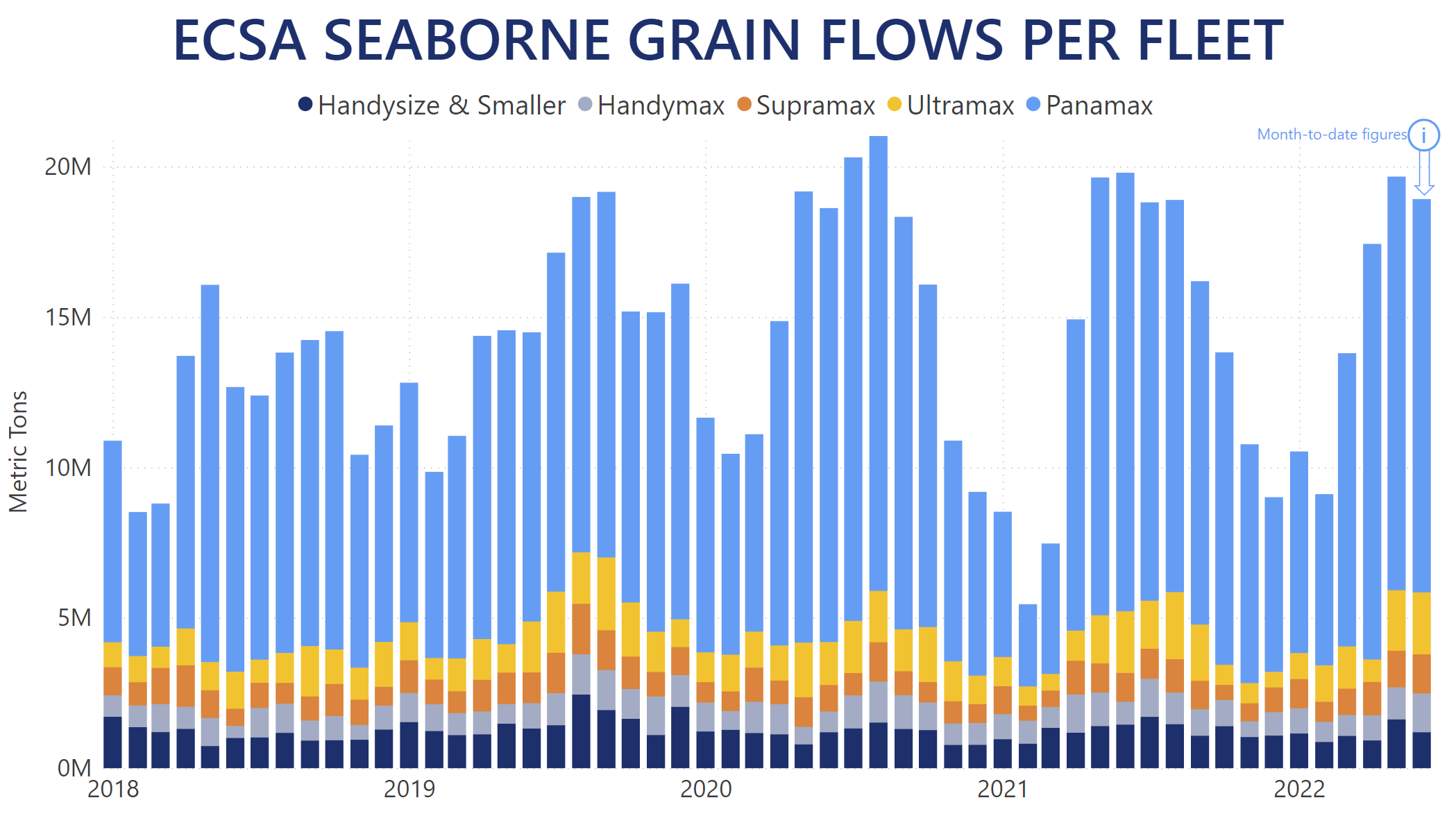

Panamax vessels carried a record 62.8m MT of ECSA Grains throughout H1 2022 for a 22.3% year-on-year increase. This gave the largest fleet segment in this market a share of 70.2% between January and June, whereas it stood at 67.8% during the same period of last year. In April alone, Panamaxes transported 78% of all cargo, which had only been exceeded once before in May 2020. Post-April, however, the smaller vessel segments transported most of the additional quantity of ECSA Grains, as Panamax shipments remained steady at around 13.5m MT per month. Supramaxes registered a 30.9% year-on-year increase throughout May and June, while shipments aboard Ultramaxes and Handies were boosted by 11.5% and 9.4% year-on-year, respectively. Overall performance in H1 2022 has Ultramax vessels carrying 8.3m MT of ECSA Grains, while Supras transported just under 6.2m MT for 21.3% and 22.7% year-on-year boosts, respectively.

With the impact of the lower forecast for Argentina crops for this season still remaining to be seen, you can use our Trade Flows tool to follow how the market develops further. Trade Flows allows you to gain accurate intelligence on a macro- and micro-level on Dry Bulk vessel and commodity movements and trends.