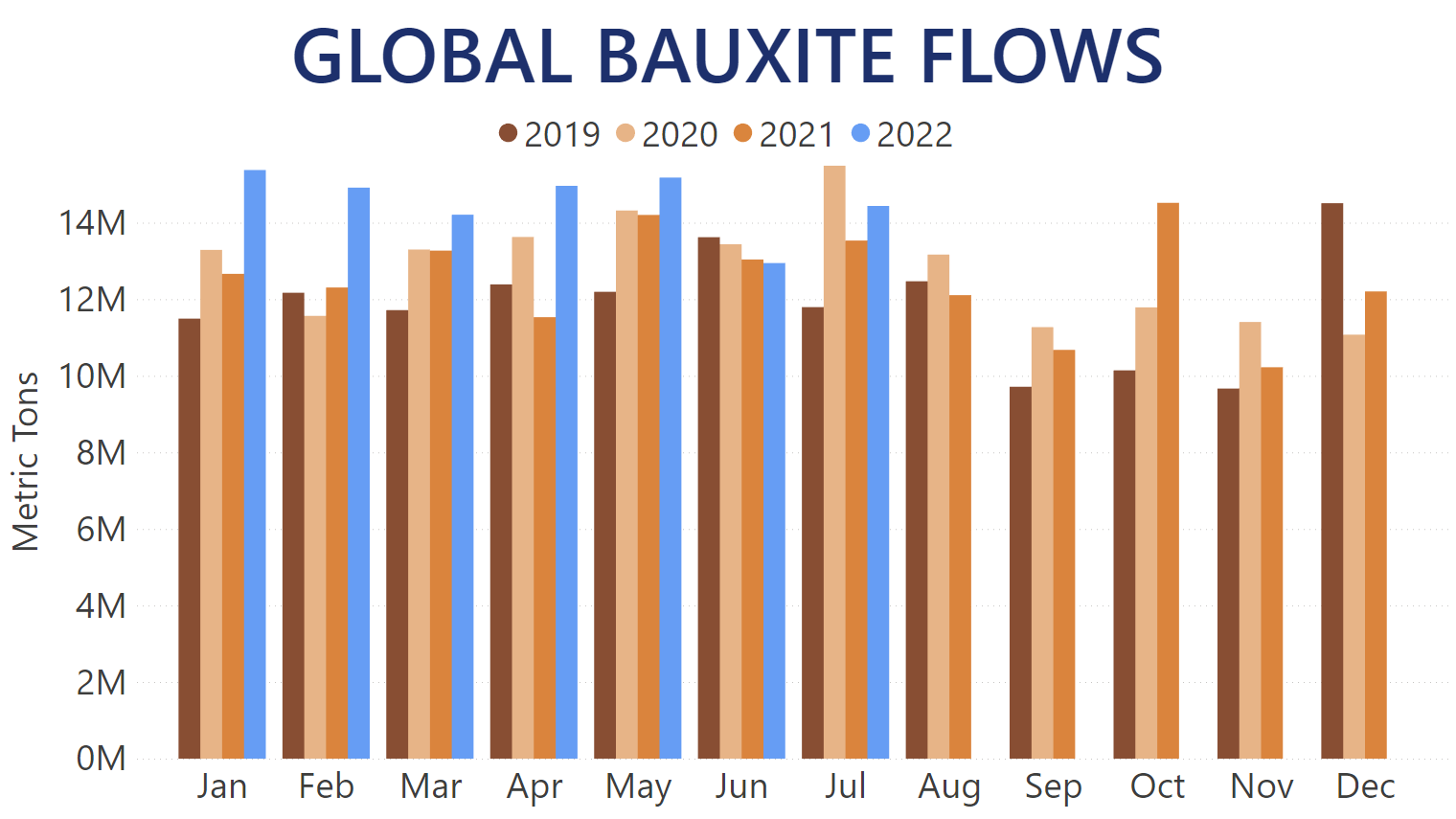

After slowing down in June from their five months of constant year-over-year gains, global Bauxite flows rebound to new highs in July. Our Trade Flows data indicates that June remains the only time in 2022 when less than 14m MT of Bauxite were discharged in a single month worldwide. The quantity imported across the globe in June represented a 1.8% year-over-year decrease, as well as a drop of 14.5% month-over-month. That being said, the record-breaking performance of global Bauxite flows between January and May, when every single month set its own record compared to previous years, meant that overall cargo carried increased by 13.8% year-over-year at 87.6m MT in total throughout H1 2022. The largest gains were registered in April at 29.8%, January at 21.9%, and February at 21.2% year-over-year. January was also the most prolific month so far in 2022, with just under 15.4m MT discharged worldwide and edged within a fraction of a percent to the absolute record set in July 2020. Meanwhile, discharges in July registered a 6.7% year-over-year increase at just under 14.5m MT.

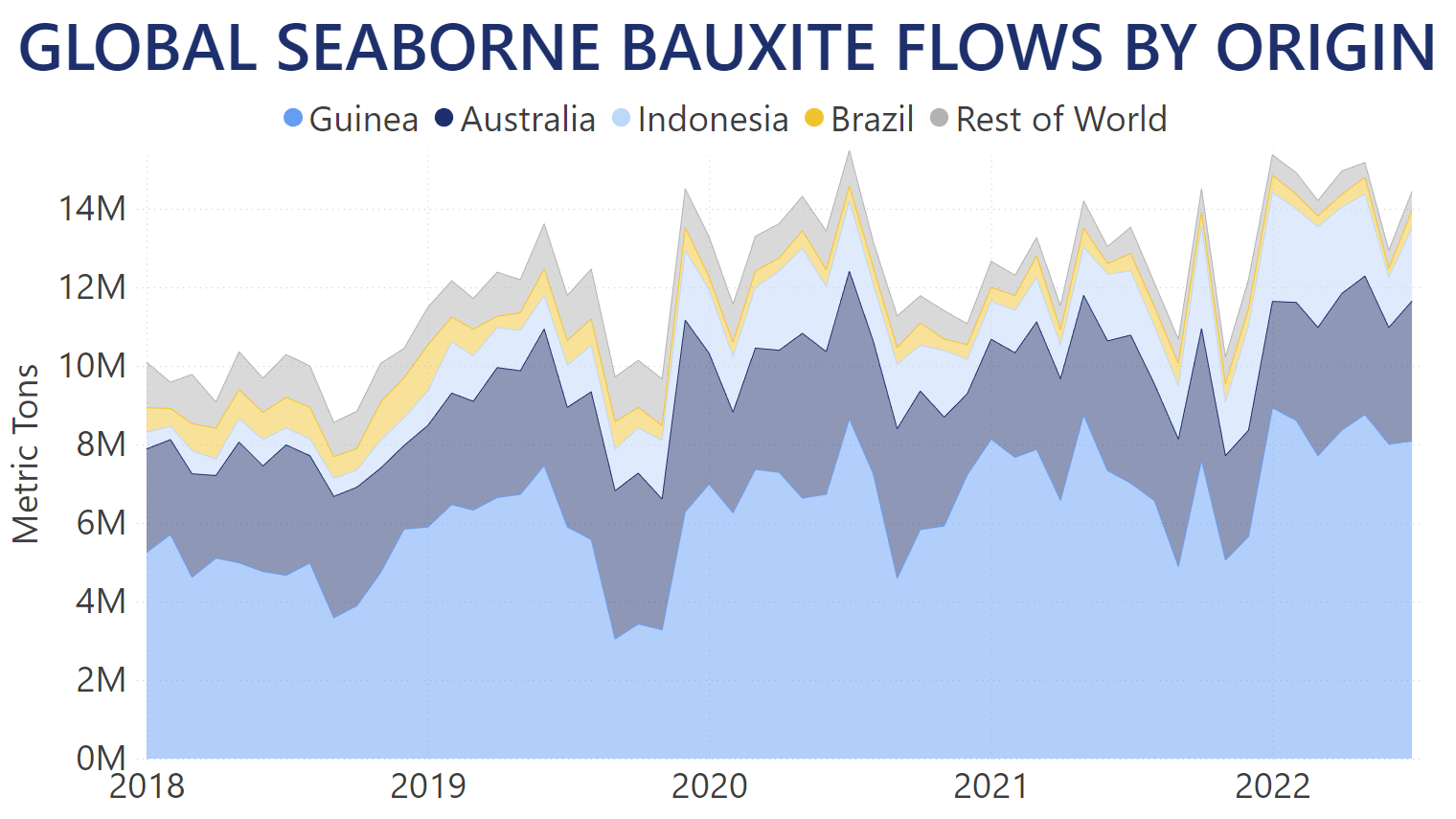

All major suppliers of Bauxite boosted their supply of the commodity so far in 2022. Indonesia registered a 76.4% year-over-year increase in its shipments between January and July, gaining a market share of 14.8% after exporting over 15.1m MT of cargo in total. Guinea remains the world's largest provider of Bauxite, shipping just under 58.8m MT for an 8.9% year-over-year increase during the first seven months of the year. This included a single-month export record set in January when over 8.9m MT of the commodity discharged across the globe originated from Guinea. Overall, 57.3% of the world's seaborne Bauxite so far in 2022 came from the ports of Boffa, Conakry and Port Kamsar. However, due to Indonesia's strong year-over-year performance, Guinea's market share was actually reduced from 58.9% during the same period in 2021. Australia remained the second-top supplier of Bauxite, shipping just over 22.5m MT in total so far in 2022. This translates into a 4% year-over-year boost and a 22.1% market share for Australia during the first seven months of the year, compared to the 23.9% it had during the same period in 2021.

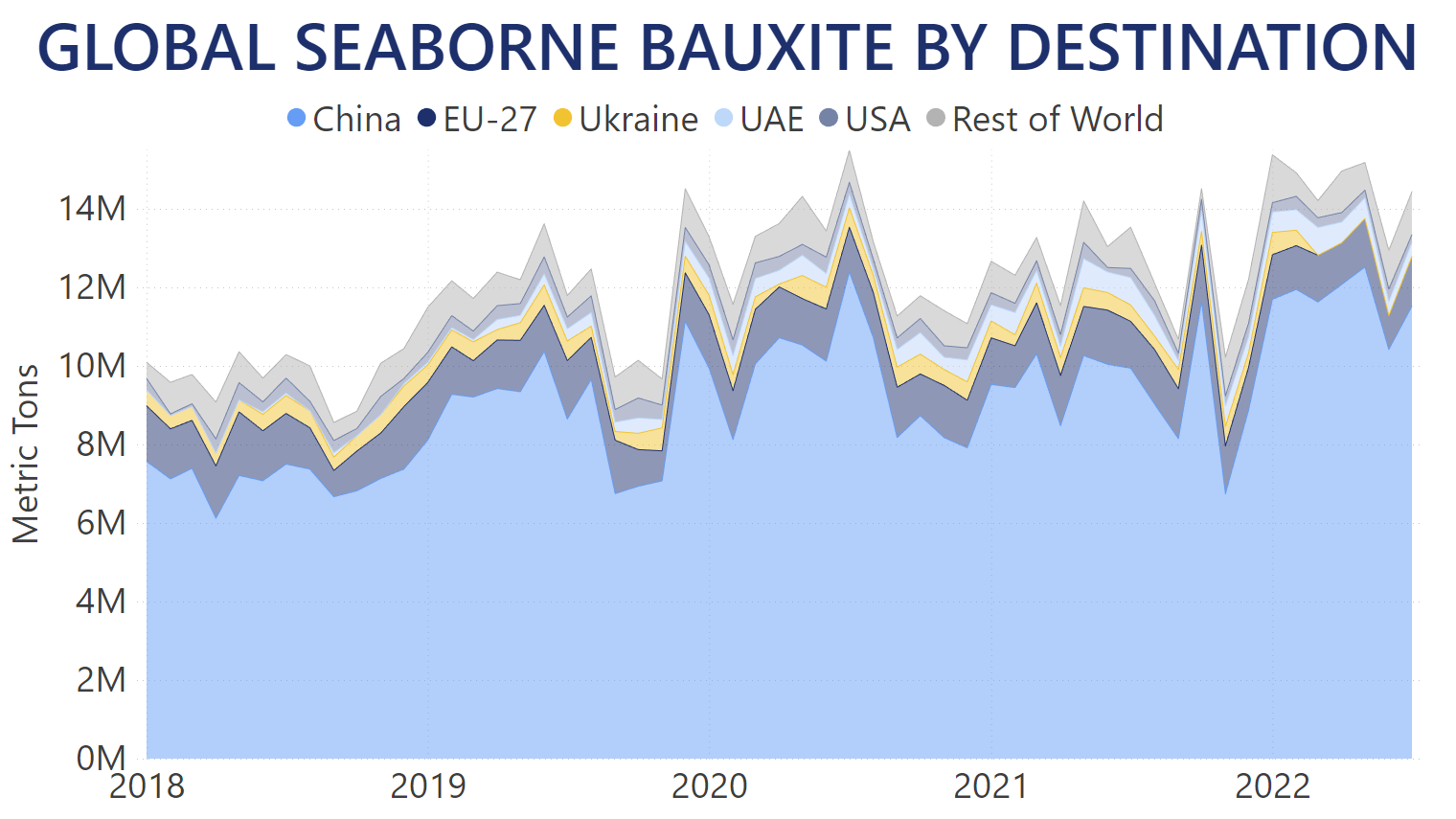

Since the start of 2022, China gained an even higher market share in the seaborne Bauxite market. The world's largest importer discharged over 81.8m MT of cargo at its ports since January, achieving a 20.3% year-over-year boost and securing an 80.2% market share against the 75.1% measured during the same period of 2021. China also set its own absolute record for most Bauxite discharged in a single month with over 12.5m MT imported in May. The EU-27 community saw its imports shrink by 9% between January and July, with June registering a lowest single-month level in nearly three years. With just under 7.9m MT discharged throughout so far in 2022, the EU-27 remains the second-largest importer of Bauxite worldwide, but its share in the market dropped to 7.7%, compared to 9.6% it had during the same period last year. Ukraine, which over the past five years has always placed in the Top 3 largest importers, saw foreign aggression grind its Bauxite imports to zero post-March.

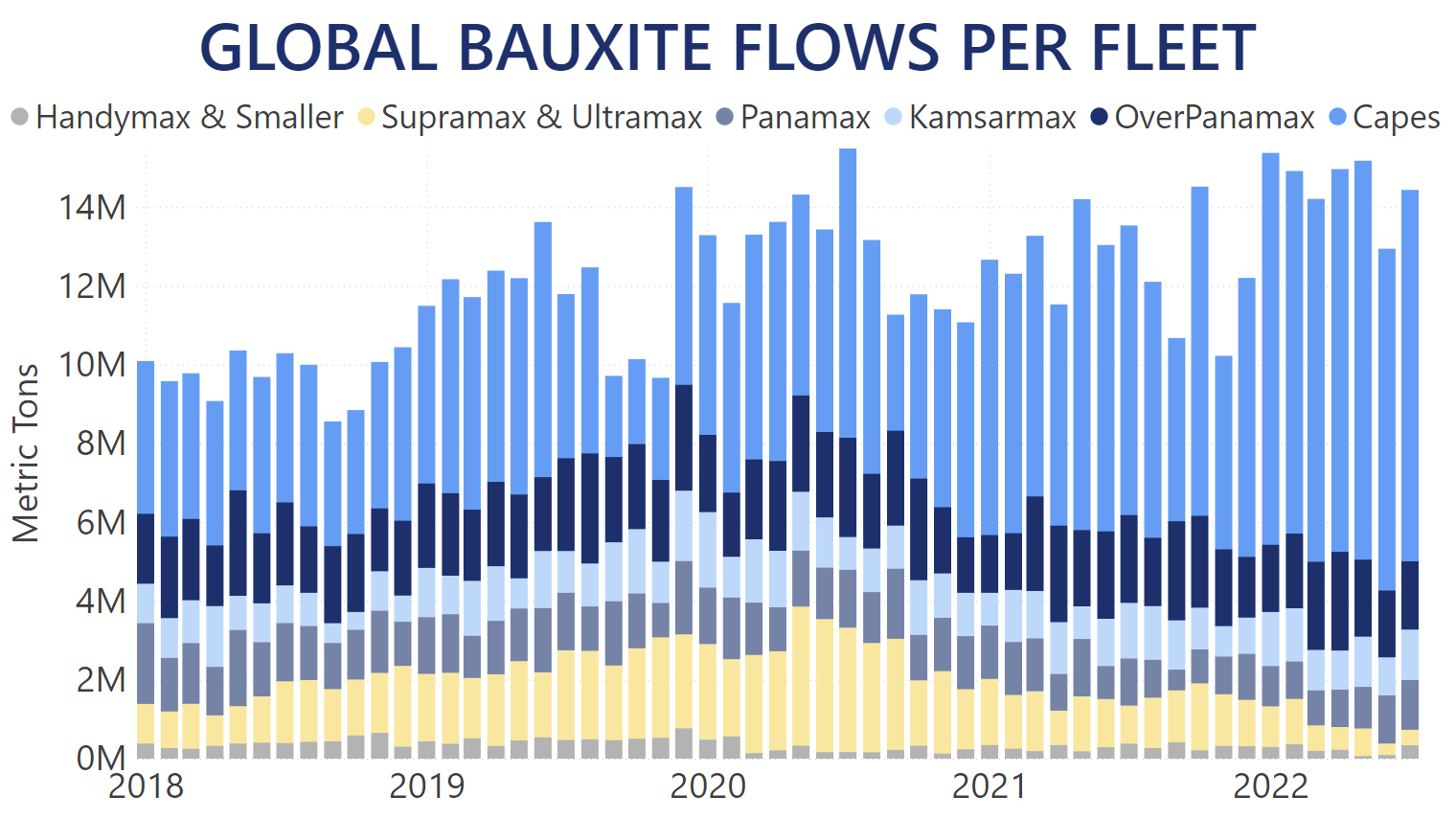

Capesize vessels over 100,000 MT of deadweight were highly used for the transportation of Bauxite so far in 2022. The largest fleet segment in the market carried over 66.3m MT, or 65%, of all the commodity. This represents a 35.8% year-over-year boost for Capes and a boost of its market share compared to the 53.9% they achieved during the same period of 2021. Virtually every single month since the start of the year has seen Capes ship more than any other single-month level on record. In May alone, over 10.1m MT of Bauxite were transported by Capesize vessels. The OverPanamax fleet registered a minor drop of 2.9% year-over-year, after carrying just over 13.7m MT of Bauxite between January and July and securing a 13.5% market share so far in 2022. Meanwhile, the Kamsarmax fleet transported just under 8.3m MT of cargo for a 2% year-over-year gain. In the context of the Capes' utilization, this meant that Kasmarmaxes also saw their market share drop from 9% between January and July of 2021 to 8.1% during the first seven months of 2022.

You can use our Trade Flows tool to follow how the Bauxite market develops further, as well as gain accurate intelligence on a macro- and micro-level on this and other topics relevant to your business.