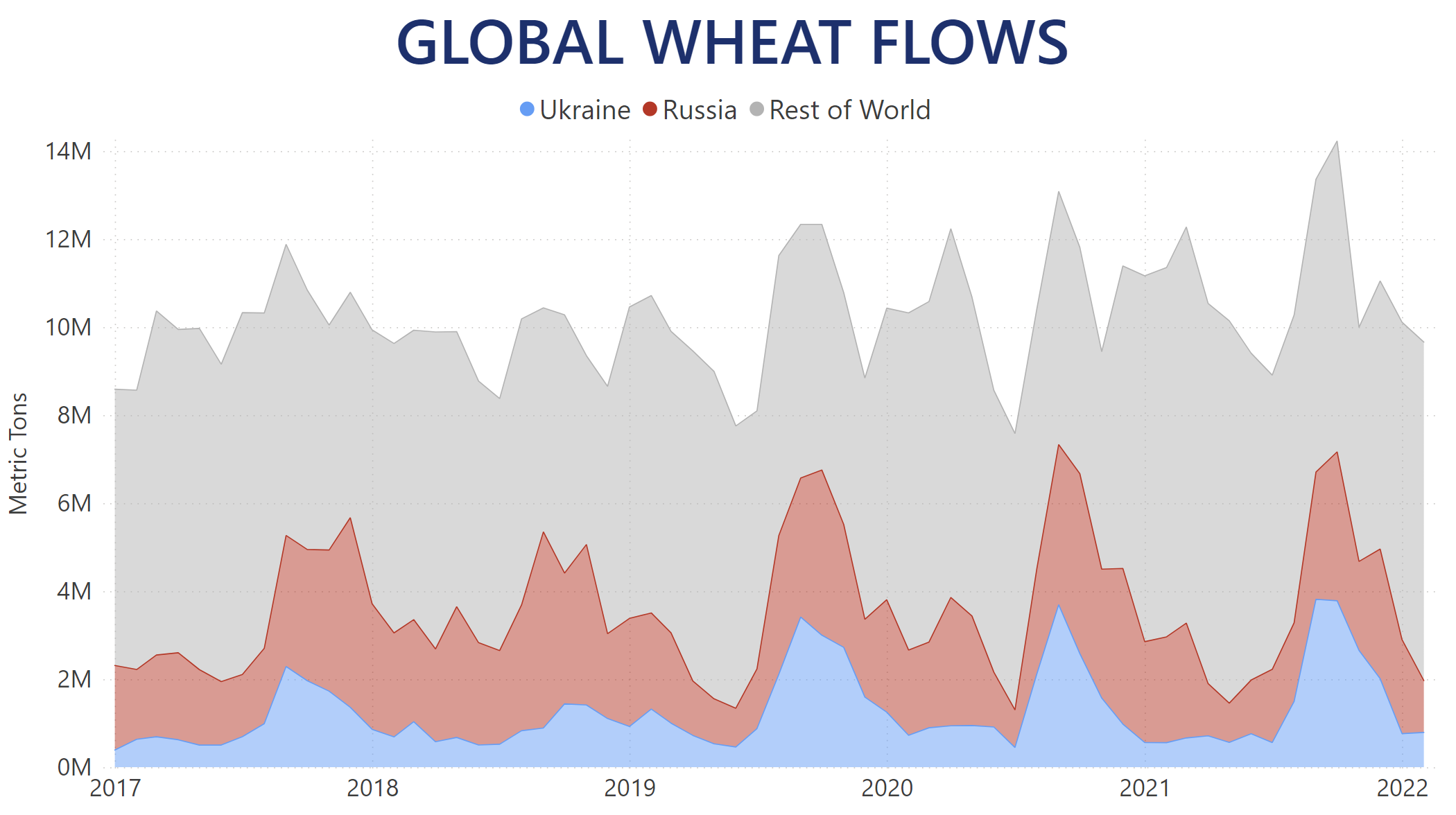

As Russia's invasion of Ukraine rages on, the uncertainty surrounding the region with massive sanctions imposed on Russia and the Ukraine’s ports being closed, has sent the price of Wheat through the roof. While contributing factors, such as US wheat farmers troubled by droughts and China dealing with bad farming conditions, definitely add to the uncertainty, it was the potential loss of 34% of the global wheat supply that shot the prices to over $400 per ton in less than two weeks. That percentage is the average of Ukrainian and Russian wheat carried by vessel over the past five years. Accounting for the seasonality of the commodity, it fluctuates from 25% between January and August to over 45% between September and December, with outlying months exceeding 56% of all shipments.

Market data suggests there are up to 6m MT of Ukrainian wheat from last season in silos, along with 8m MT in Russia. However, Ukraine's access to the sea is currently blocked, while ship owners, charterers and bankers are reluctant to get involved with vessels carrying Russian wheat due to the potential of very quick financial disaster. Obviously, the situation will only worsen the longer the war goes on, but even in the now foregone optimistic scenario of a quick end, if Ukraine could restart shipments as soon as possible, the consequences of Russia's invasion would still have been present throughout next season, as Ukrainian farmers would have been deterred from planting crops in the usual timeline. As far as Russia is concerned, it's proven next to impossible to believably predict how her sanctions would affect her or what lies ahead.

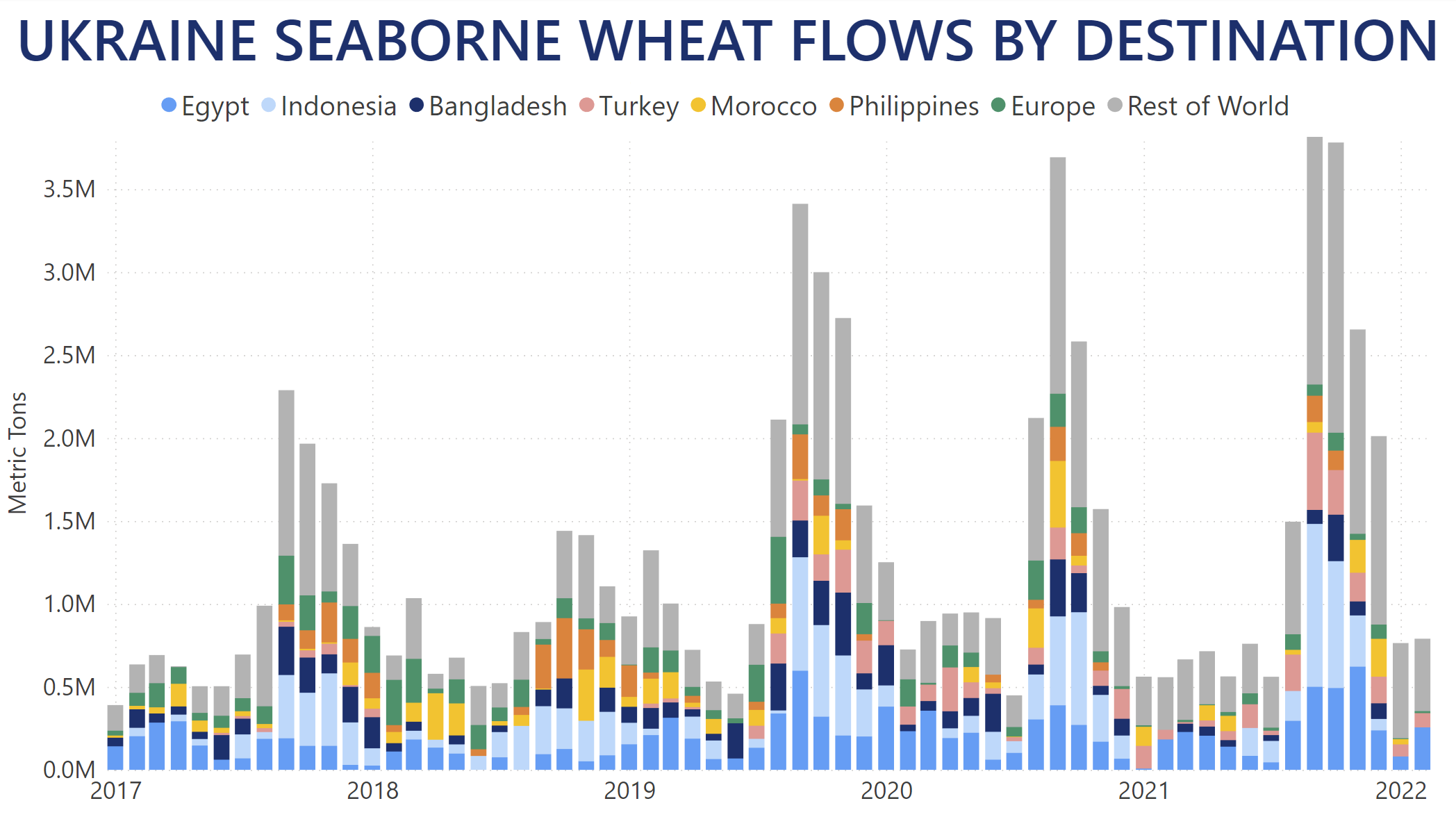

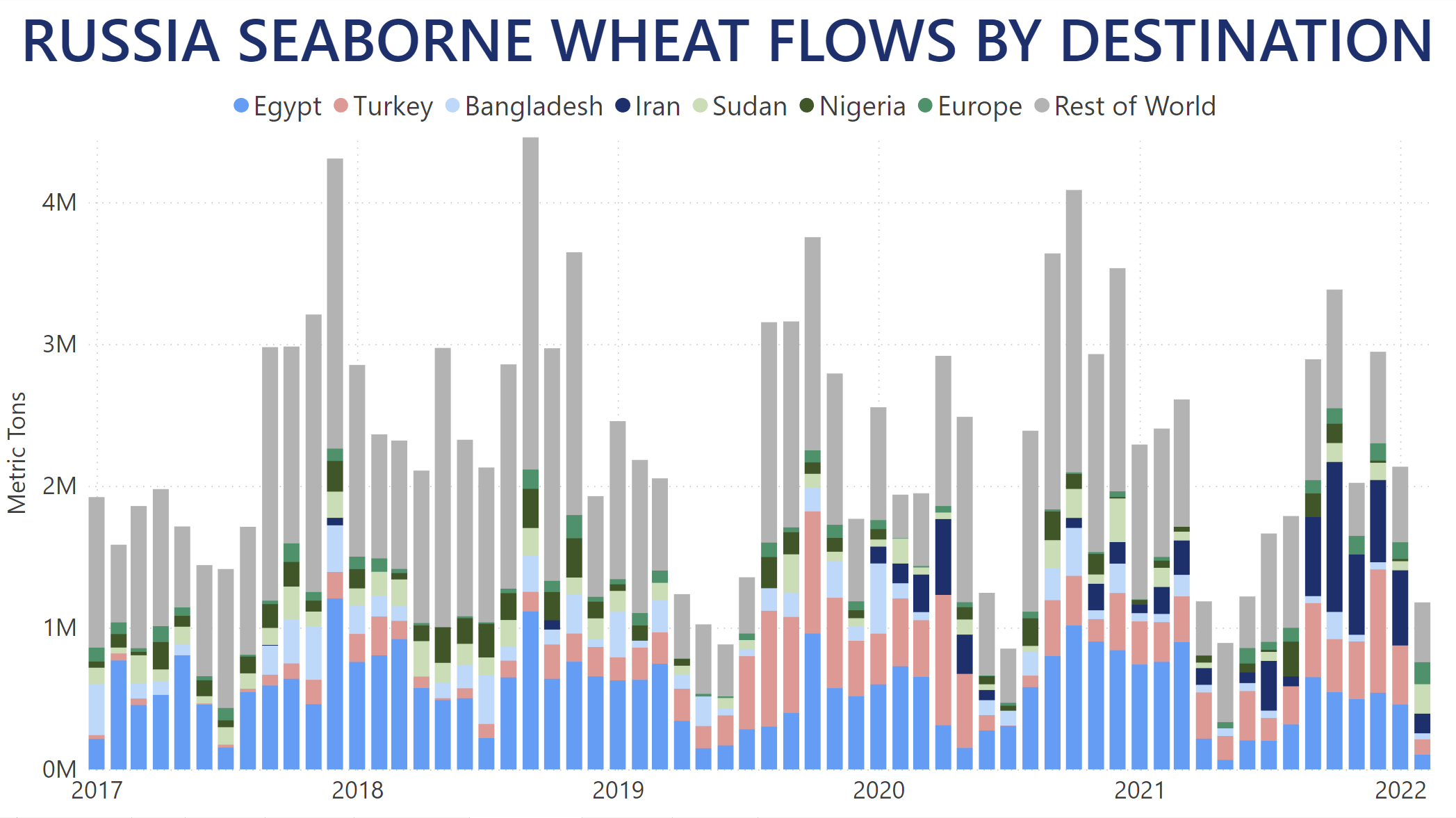

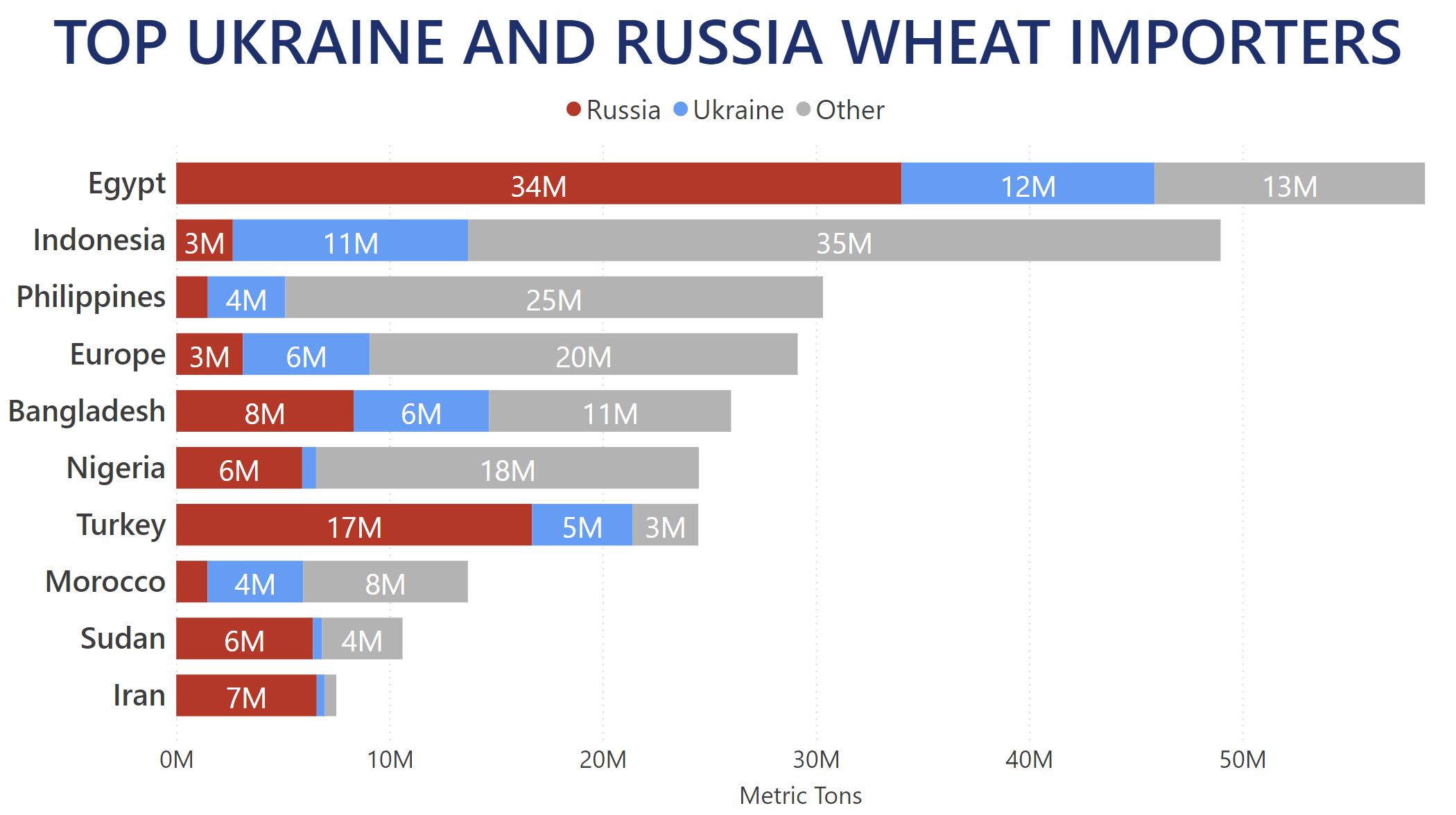

Taking a look at both countries' Top 6 wheat importers, Egypt, Turkey and Bangladesh are present in both charts, accounting for 29% of all Ukrainian and over 40% of all Russian wheat exports over the past five years. By comparison, the entirety of Europe had an 8% market share of Ukrainian shipments and 2% of Russian seaborne wheat.

This puts the aforementioned three at an elevated risk in terms of food security, considering their own import profiles. In Egypt's case, 58.1% of the 60m MT of wheat it imported by sea throughout the last five years came from Russian ports, while 20.3% was sourced from Ukraine. With Bangladesh, out of over 26m MT of wheat, 31.9% came from Russia and 24.4% from Ukraine. Turkey is the most impacted of the three, percentage wise – importing nearly 25m MT of wheat by vessel since 2017, 68.2% originated from Russia with a further 19.3% from Ukraine.

The only country with a more lopsided import profile is Iran, which saw over 87.7% of its entire wheat shipped from Russian ports since 2017.

While Europe appears in a better position by comparison, during the last half a decade over 31% of its 29m MT of seaborne wheat imports were delivered by either Ukraine or Russia.

Apart from "When will the war end?", perhaps the second question that comes to mind is "Can Russian and Ukrainian wheat be replaced?". Unfortunately, the most likely answer is no. Putting things into perspective, the sum of their shipments in 2021 exceeded that of the second and third largest exporters, Australia and the US, combined. This is without taking into account the difference between a voyage to Alexandria that starts from Mykolaiv or Novorossiysk as opposed to Portland or Kwinana.

While wheat exports have so far been kept out of the sanctions package, moves such as the Russian Ministry of Economic Development's ban on grain exports to EAEU countries have added to the uncertainty in the market and food security risk.

You can follow how this topic develops, as well as any other commodity in the market using our Trade Flows tool.