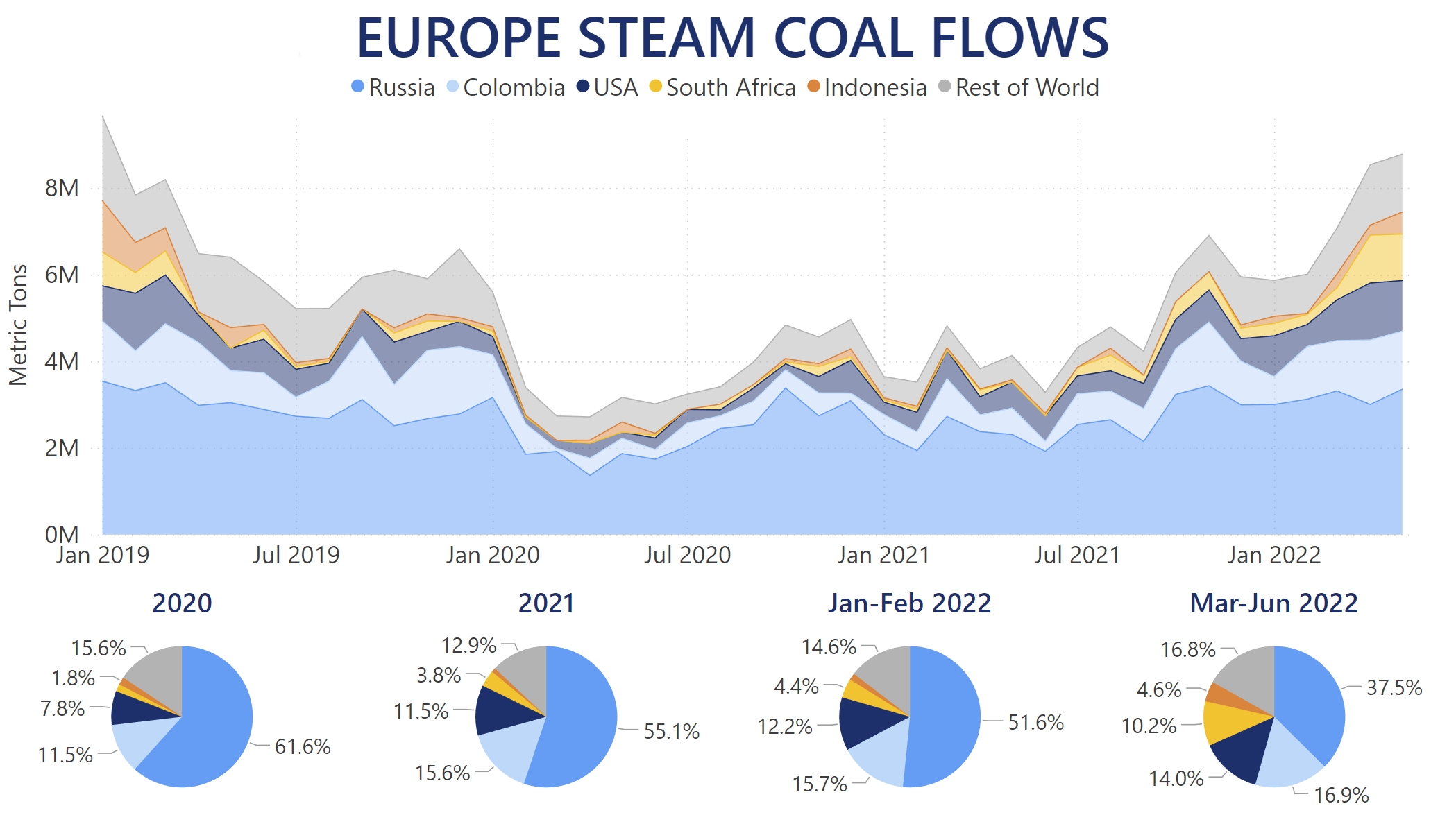

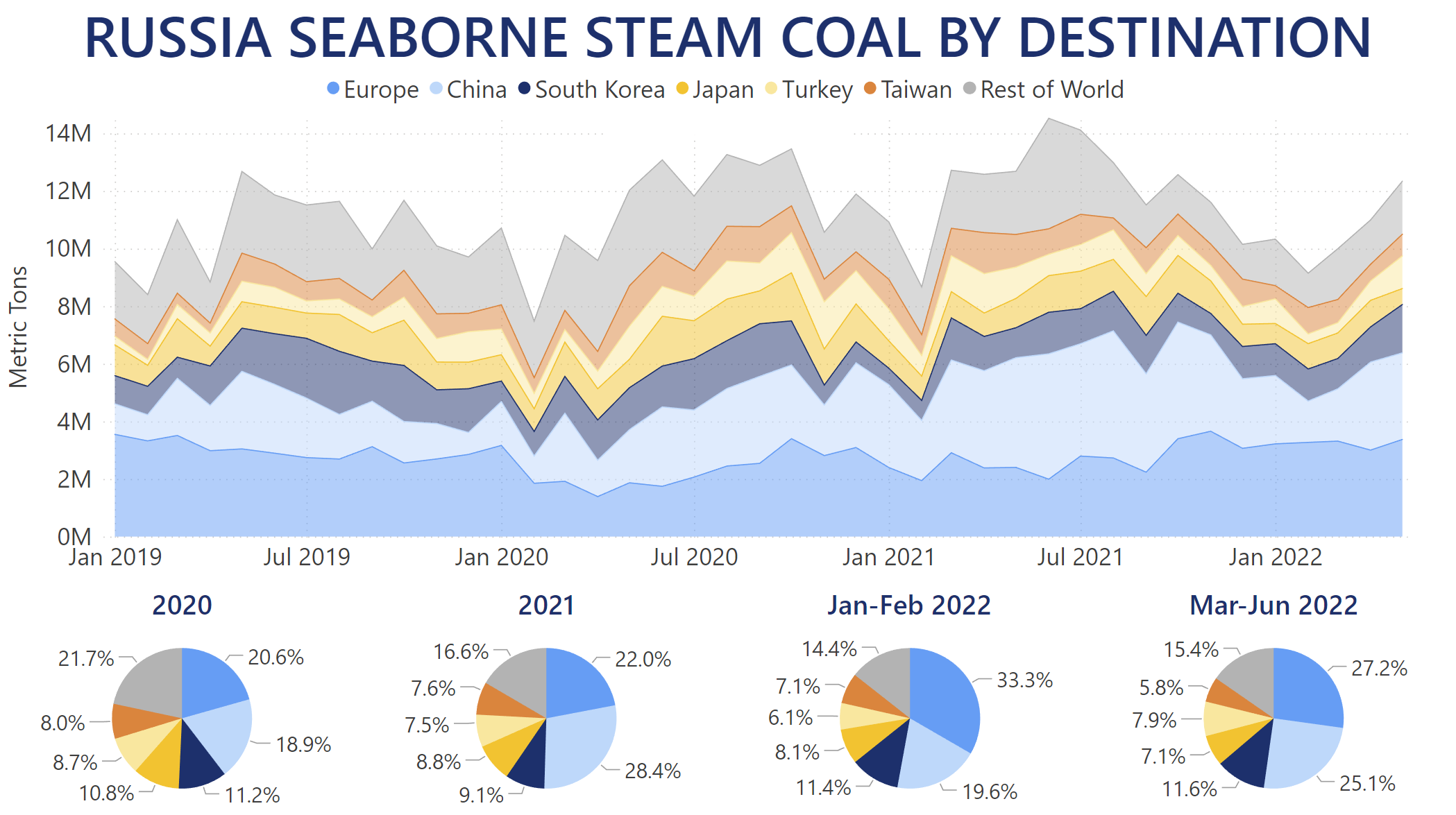

Despite some media reports claiming Europe is already shunning Russian Coal imports, our Trade Flows data suggests otherwise. The EU-27 and the UK combined have continuously imported about 3m MT of Steam Coal per month from Russia ever since last October. On the surface, this represents an average year-on-year increase of about 30% each month since then. However, as the European nations' demand has grown post-March, they have increasingly sourced their Steam Coal imports from other countries. Between March and May 2022, Steam Coal shipments from Colombia to Europe increased by over 113.8% year-on-year. Over the same period, this commodity carried from the US was boosted by 163.9%, compared to 2021 levels. Steam Coal from South Africa to Europe also increased over twenty-fold year-on-year since March. Meanwhile, latest data in June suggests that even voyages all the way from Australia are being discharged across European ports.

All of this has diminished Russia's share of the European market from over 50% between January and February to 37.5% over the past three months. The drop is even more significant, considering Russia supplied over 55% of all European Steam Coal in 2021, and over 61% in 2020.

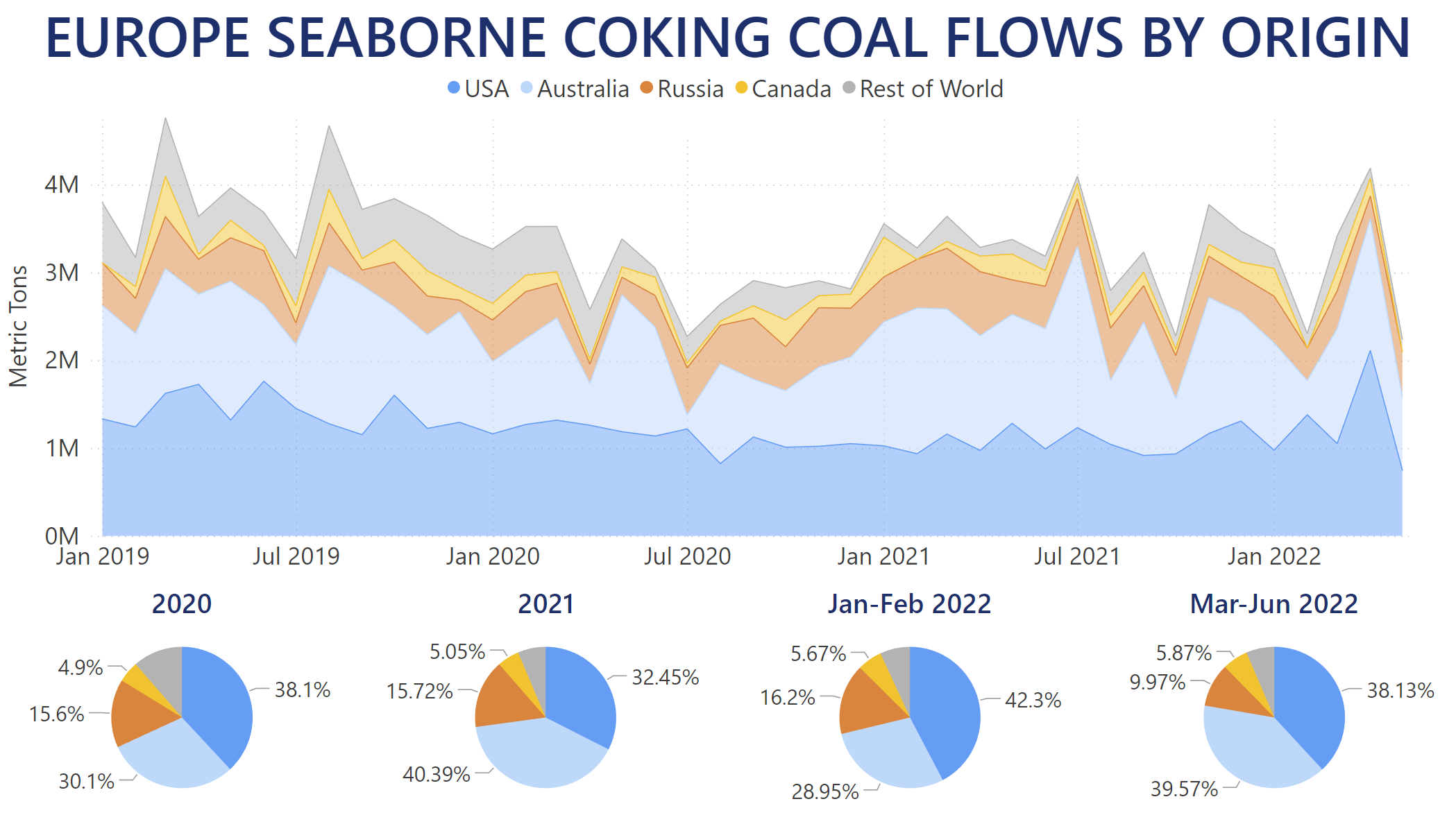

Coking Coal shipments to Europe have been on the decline overall since the start of 2022. In any case, Russia has not been the largest supplier in this market in recent years. Since the onset of March, nearly 5m MT of Coking Coal have been imported from the US for a 14.6% year-on-year increase. Over the same period, shipments from Australia also exceeded 5m MT. However, this was actually an 8.4% year-on-year decrease. Post-March, deliveries from Russia currently stand at less than 1.3m MT, which translates into a 33.6% year-on-year regression.

This also reversed Russia's increasing market share in European Coking Coal deliveries, which was boosted to 16.2% in January and February, compared to an average of 15.6% and 15.7% over the past two years. After March, Russian Coking Coal was less than 10% of the entire European demand on this market.

While volumes to Europe remain plateaued at the moment, Russia has ramped up its Steam Coal exports elsewhere. China imported over 10m MT of Russian Steam Coal between March and mid-June, increasing discharges of the commodity by 31% on average month-on-month compared to January and February levels. Nevertheless, this still represents a 24.7% year-on-year decrease. South Korea also increased imports of Russia Steam Coal post-March, discharging nearly 5m MT at its ports, for a 7% year-on-year boost. Turkey has also been boosting shipments by 54% on average month-on-month since the end of February. Meanwhile, Japan has curbed its imports of Russian Steam Coal by 13.9% year-on-year since March.

This means that while Europe's imports represented about a third of Russian Steam Coal shipments in January and February, its market share has dropped to 27.2% between March and mid-June.

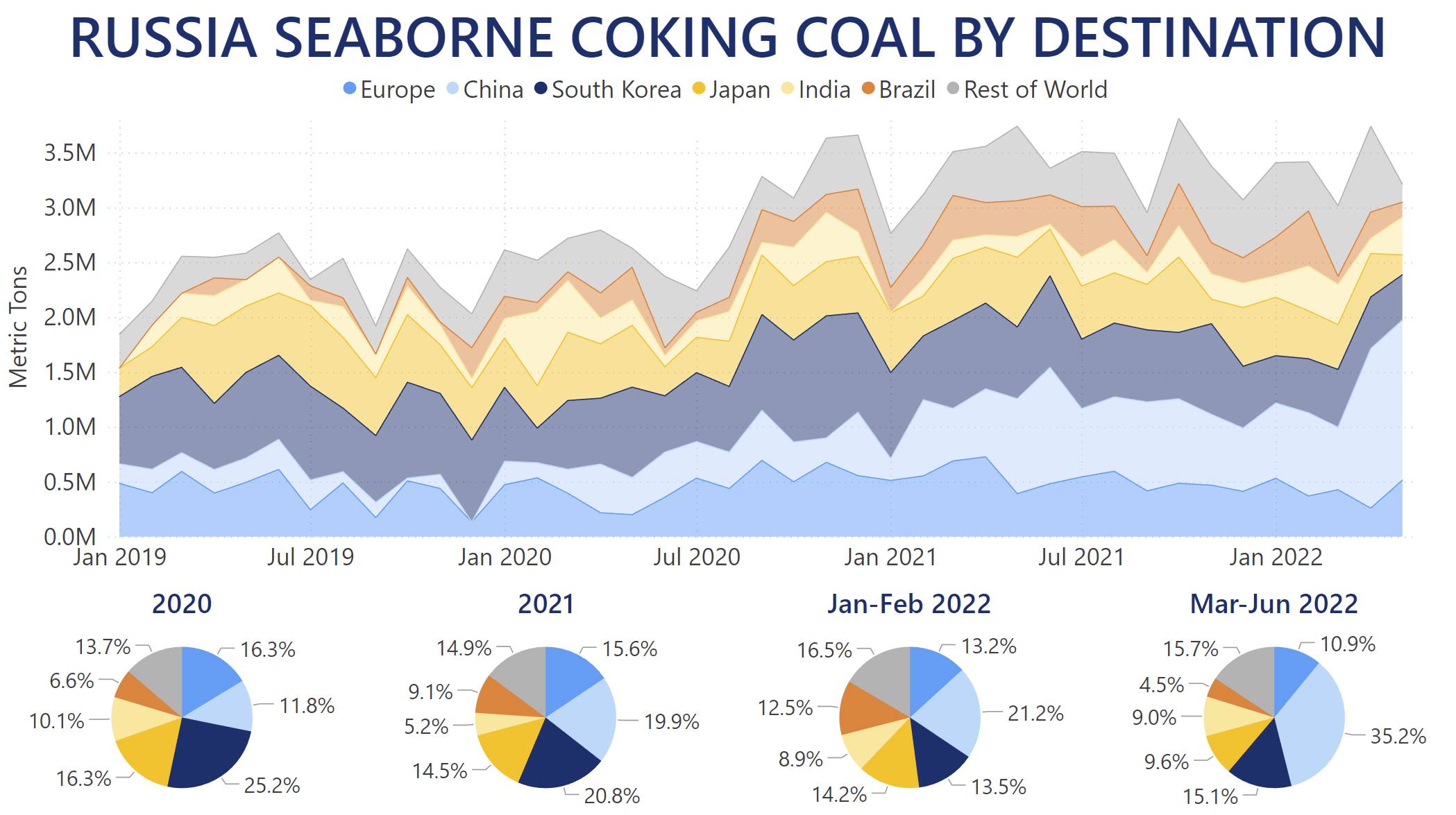

Russian exports of Coking Coal to China and India partially compensate for decreasing quantities to Europe, Japan, and South Korea. The most drastic change here can be observed in Chinese imports increasing by over 77.3% year-on-year post-March. Quantities discharged in April and May in particular registered record levels at over 1.4m MT each month, compared to import levels of recent years. On the other hand, Japan slashed its imports of Russian Coking Coal by 42.5% year-on-year over the same period.

Overall Coking Coal quantity exported from Russia has decreased by 7.7% year-on-year since March, whereas it was on the rise to the tune of 15.9% year-on-year in January and February. European market share also decreased to less than 11% since March, whereas it stood at 13.2% in January and February.

With talks of further sanctions and potential European halt of Russian Coal altogether around August, you can use our Trade Flows tool to follow how the market develops further. You can also gain accurate intelligence on a macro- and micro-level on this and other topics relevant to your business.